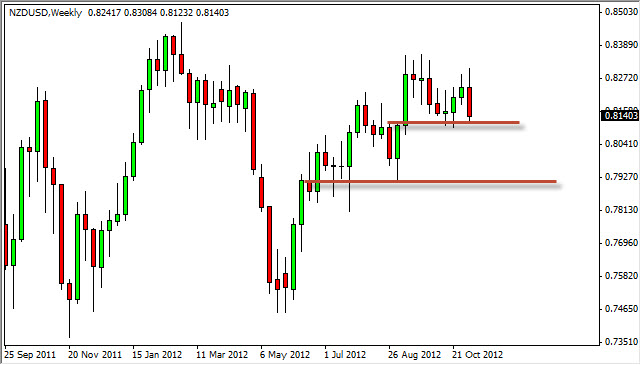

EUR/USD

The EUR/USD pair had a rough week over the last five sessions as the general risk appetite fell through the floor. This was especially true once the word got out that Germany is slowing, and will more than likely enter a recession. This is especially bad news for the Europeans as the Germans were to one bright spot. Because of this, I think the bias is still to the downside as the troubles in Europe continue.

The Spanish bond yields continue to rise, and the debt issues aren’t getting any better in general. The Americans are currently arguing of the “fiscal cliff”, and as such this will keep this pair from falling precipitously. However, I do believe that we continue lower. A break of the bottom of this candle signals the next leg lower.

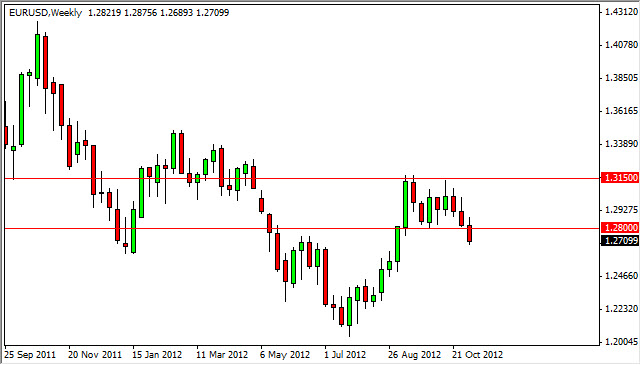

USD/CAD

The USD/CAD pair is one of the most interesting ones to me at the moment. The pair looks like it is trying to wind up for a larger move. The candle for the week is a hammer, and the placement of it is at a crucial spot. The pair tends to rise in times of financial uncertainty – which is something we have in spades at the moment.

The parity level is the top of a support and resistance “band” that goes down to the 0.99 level. With this in mind, it appears that we are trying to bounce out of this area, and towards the top of the recent consolidation area that stops at the 1.04 level. If we manage to get above the 1.0050 level – I am buying.

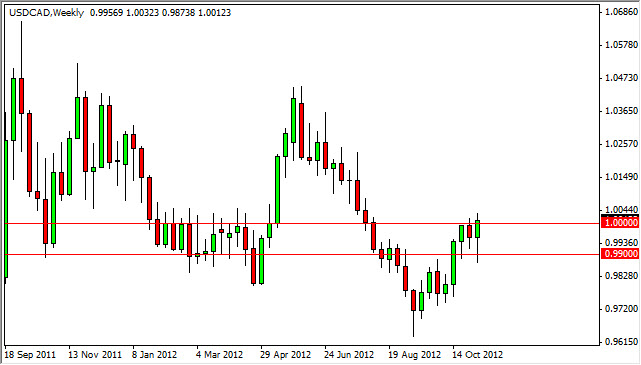

AUD/USD

The AUD/USD pair looks very suspicious to me at the moment. The candle for the week is a shooting star, and it is at the 1.04 level – an area that is very resistive. The area is the “middle point” of a large consolidation area between 1.02 and 1.06 that goes back several months. This looks like a failed attempt to reach the top again, and this is normally a sign that we may fall through the bottom. On a break of the bottom of the shooting star, I will be selling this pair.

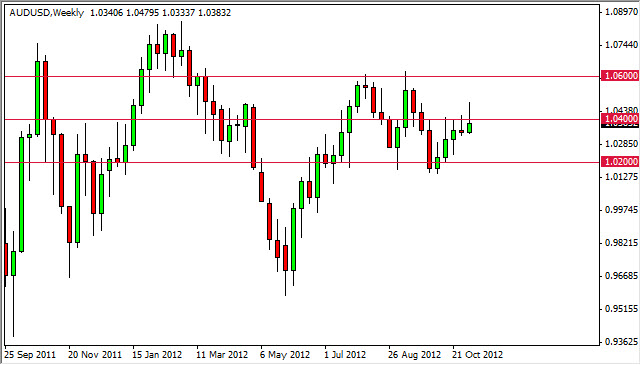

NZD/USD

The NZD/USD pair had a rough week, and the “risk off” attitude of the markets certainly will not have helped. The Kiwi dollar tends to fall when risk appetite does as well. The 0.81 level below current price looks to be supportive, and if we get more bad news – this pair will more than likely fall through it.

Below that, the 0.79 level is supportive as well. I think that the market will aim for this level in relatively short order if we start falling. As for buying – I see far too much risk at the moment.