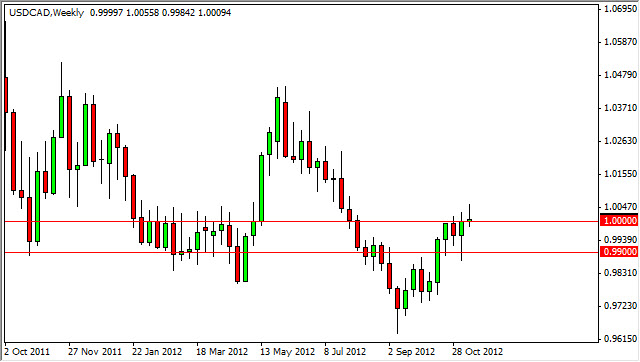

EUR/USD

The EUR/USD pair currently sits on top of the 1.27 level, an area that I see as very supportive. The action this last week wasn’t much to write about and as a result I think we are trying to form some kind of base.

However, there are a lot of headline risks out there at the moment, and this will more than likely result in choppy trading. This pair will be thrown around by the headlines, but at the moment I would have to say a bounce looks very likely.

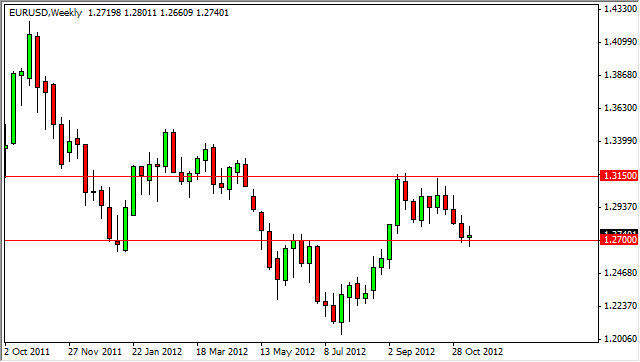

AUD/USD

The AUD/USD pair seems to have trouble getting over the 1.04 level. This is the “middle” of a major consolidation area that has support at the 1.02 levels, and resistance at the 1.06 level.

When consolidation doesn’t quite make it to the other side of the rectangle, this is often a sign of things to come. The pair doesn’t seem to be willing to roll over and play dead quite yet though, as the Friday candle was a hammer. Nonetheless, I would be nervous about buying this pair at the moment. With this in mind, I am looking for weakness to signal further selling.

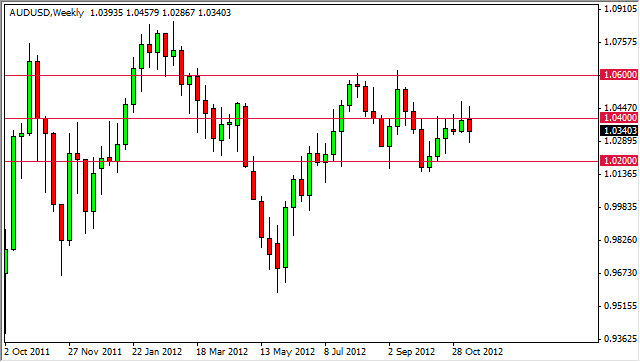

GBP/USD

By far the most interesting weekly chart, the GBP/USD features a hammer right above the 1.58 level. This level was an area that I thought could offer support on the pullback, and it looks as if that is exactly what is happening at this point in time.

If we can break the top of the week’s high – I think this pair could take off for the upside yet again. I can see a run all the way to the 1.63 level quite easily. I do see a bit of support all the way down to the 1.57 level, so selling isn’t really a thought at the moment.

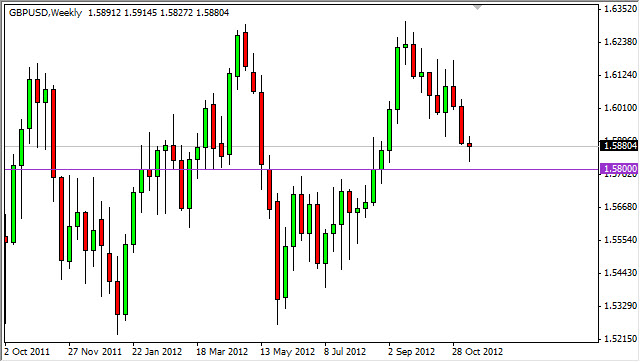

USD/CAD

The USD/CAD pair formed a shooting star for the previous week. While this would normally have me very, very interested in selling the pair, the truth is that we are presently sitting on top of a ton of support.

The 0.99 to parity zone is supportive, and as a result I don’t necessarily trust the sell signal until the 0.99 level is cleared by the sellers as well. The entire area should be a massive supportive zone, and with all of the headline risks and general lack of demand for oil presently – we could see further CAD selling. If that’s the case, I think a break above the past week’s highs sends this pair back to the 1.04 level.