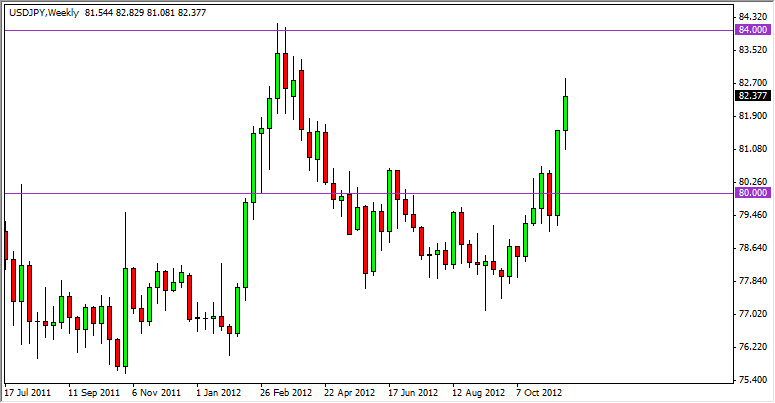

EUR/USD

The EUR/USD pair rose during the week over the last five sessions, and looks set to retest the 1.3150 level for resistance. Whether or not it can get through that level is questionable, but it certainly looks as if it will try.

The situation in Europe is a fluid one, but then again so is the “fiscal cliff” situation in the United States. Because of this, I think this pair will continue to be very headline driven, and could be difficult to trade from a longer term aspect. However, I would be the first to admit that there is an upside bias at this point.

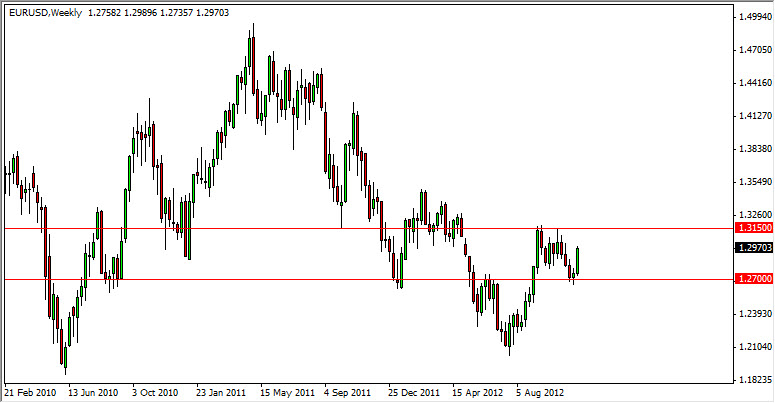

EUR/JPY

The EUR/JPY pair has skyrocketed over the last five sessions. I think that this is a culmination of “hopium” with all things European again, and more importantly the Bank of Japan’s soon to be mandate of a 3% inflation target. They will only be able to achieve this by printing Yen, and a lot of it. In other words, the Japanese are declaring war on their own currency again.

With this in mind, I am interested in buying this pair on pullbacks as I think we have a lot of inertia building up. This is probably just the start of the run higher, and I think that the next serious resistance area won’t be found until we see the 110 handle.

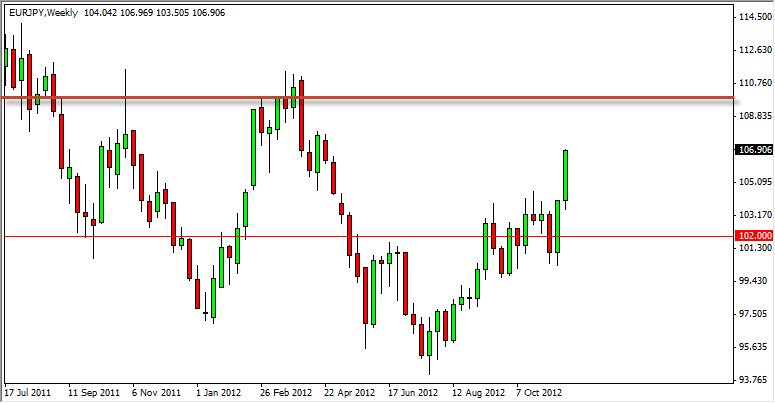

GBP/USD

At the moment, this is one of the most interesting positions that I hold. I am already long of this market, and based this upon a break higher from the hammer that formed last week. The 1.58 level is the supportive zone I wanted to retest because of the previous triangle that had broken over the summer. We had a target of 1.63 based upon the triangle’s height, and now I think the hammer being broken to the upside suggests that the market will return to test the 1.63 again.

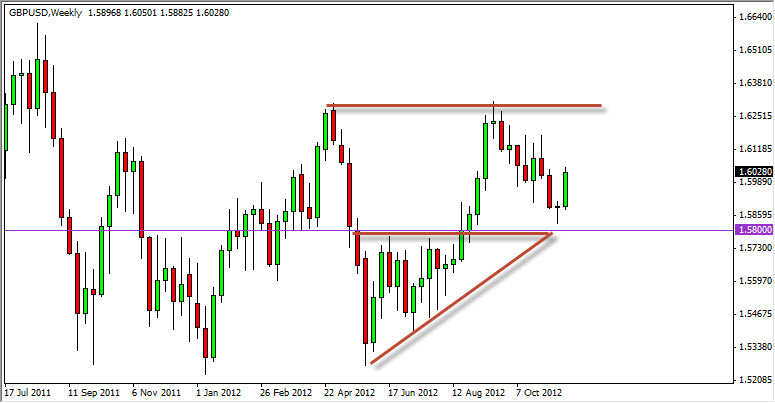

USD/JPY

The USD/JPY pair rose again over the last five sessions, and seems destined to reach the 84 handle at this point. I have written about the importance of the 80.50 region being broken to the upside, and now I think there is little to keep the pair from challenging 84. If it can break out from there – we could be looking at a massive buy-and-hold situation going forward.

The pair will be a buy on pullbacks as well, as I see 80 as being the “floor.” With the Bank of Japan watching your back, this could be a very profitable trade over time. I will be buying this market every time it falls.