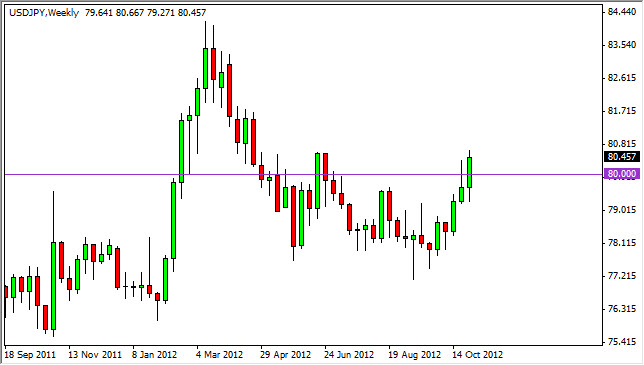

EUR/USD

The EUR/USD pair had an interesting week as the 1.30 level continues to cause major issues for the buyers. The pair finally broke down a bit on Friday as the 1.29 level finally gave way. The breaking of 1.29 was significant, as it showed the uptrend line that was as prominent on the daily chart collapse as support. However, the 1.28 level looks as if it is major support, and I believe that if the level falls – this could be the start of a major leg down. I believe that we are right on the precipice of a big pro-Dollar move.

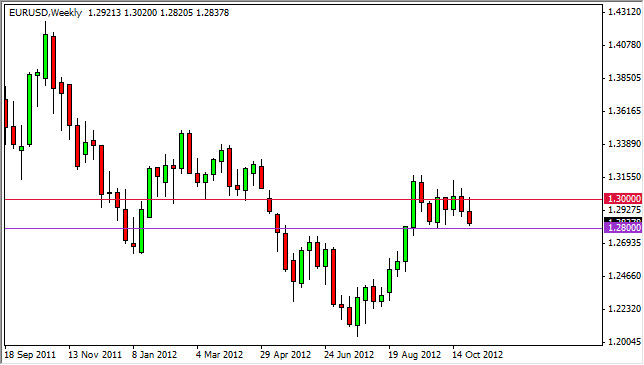

AUD/USD

The AUD/USD pair has been consolidating between the 1.02 and 1.06 levels for some time now. The pair certainly has a lot to consider, as the Reserve Bank of Australia looks set to cut rates in the future, and the Chinese economy has had some fairly weak numbers lately as well.

However, the Federal Reserve continues to ease its monetary policy, and as a result the commodity markets are held a bit higher than they truthfully should be. Anytime you get easing from the Fed, it tends to support commodity prices, and as a result gold and other hard assets go higher. It is because of the Fed and gold that the Aussie hasn’t fallen any farther than it has.

However, the latest return from the bottom (1.02) hasn’t made it past the “middle line”, or the 1.04 level. This is often the first sign of trouble, and it appears that after this week formed a shooting star, we could be ready to see prices fall again. I think we aren’t too far from breaking below the 1.02 level – and this would have us at parity fairly soon.

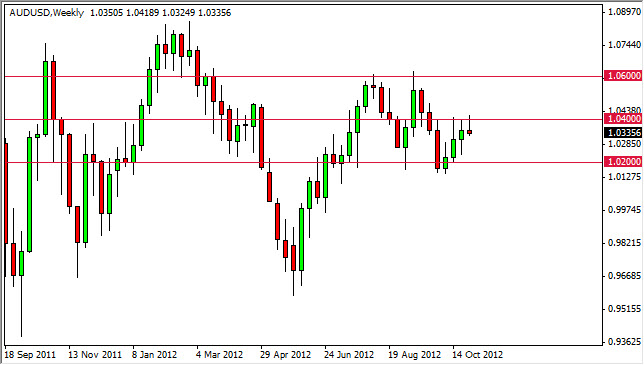

USD/CHF

The USD/CHF pair has been mostly left in the shadows with all of the drama around Europe. After the Swiss National Bank placed a “floor” in the EUR/CHF pair, the world simply left the Franc alone. However, this pair has been a bit of a slow and steady grinder and this suits me fine. In a pair like this, you can place longer-term trades and simply let them run on their own.

The 0.9250 level looks like serious support, and we have formed a hammer for last week. This is obviously a supportive candle, and the top of the candle is the 0.94 handle. If we can get above that – this pair should head back to the 0.99 level again.

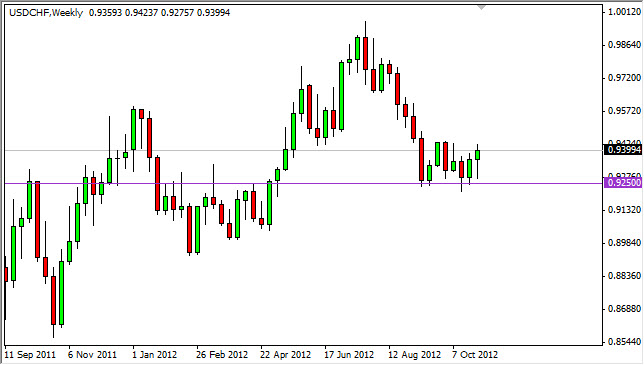

USD/JPY

The USD/JPY pair will be the most interesting to me this week. This pair will more than likely react to the Presidential election in the United States. Mitt Romney has already made it clear that he isn’t a big fan of Ben Bernanke, and a Federal Reserve without Bernanke could act drastically different. Bernanke is set to have his term run out at the end of 2013, but has recently suggested he may retire before them. Romney will only confirm and lobby for someone that isn’t as free and easy with the currency. In fact, if Romney wins the election – this pair will skyrocket.

This is simply because the Bank of Japan is still committed to easing, and is getting a lot of pressure from Japanese officials to continue to ease the monetary policy. This possible combination of a Romney win and a BoJ move could really push this pair higher. I think a break of this past week’s candle has this pair looking for 84, and possibly beyond. If Obama wins, this pair will fall.