Gold prices climbed higher as the conflict in the Middle East continued to intensify, which increased demand for safety. Lately, gold has been the best places to park their cash for the investors as global economic slowdown is expected to weigh on growth in Europe and the United States. In addition, optimism over American politicians’ efforts to reach agreement on the nation’s budget eased the greenback’s safe-haven appeal.

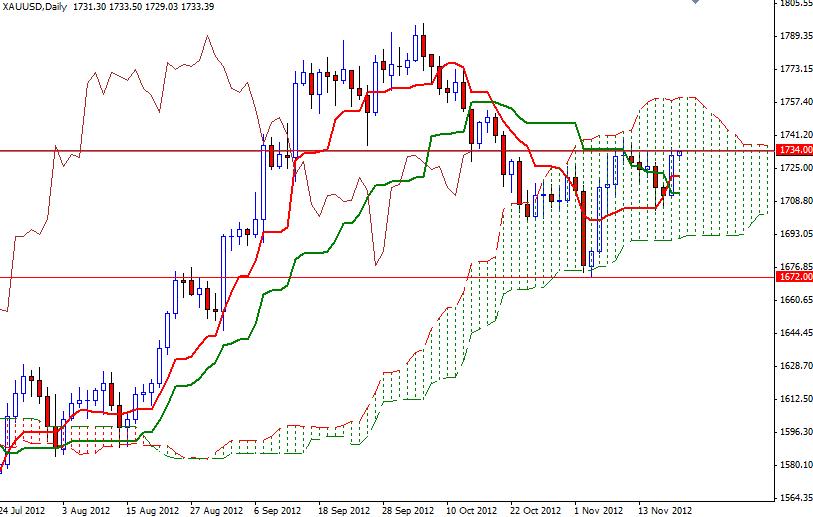

On the daily chart, XAU/USD continues to move inside the Ichimoku cloud. This indicates that there is an intense battle going on between the bears and bulls. But Tenkan-sen line (nine-period moving average, red line) crossed above the Kijun-sen line (twenty six-day moving average, green line), that is a bullish sign.

On the 4 hour time frame, XAU/USD broke out of the descending channel which it respected since November 9. Yesterday’s price action indicates that there is more strength and volume behind the bulls but price will need to close above 1734 in order to confirm the mid-term bullish continuation.

If we can successfully break through 1734, then the next targets will be 1738.90, 1747.30 and 1753.20. However, if the headlines support the American dollar and the pair reverses, there will be support for the pair at the 1729 level as well as at the 1725.30 level. Further support comes in at 1720.12.