The AUD/SGD pair is a good way to read where the money flows are going in Asia. After all, the Singapore dollar is somewhat a proxy for the Chinese yuan. This being said, you can somewhat gauge how much money is flowing from Asia into Australia to buy commodities. This is a sign of economic health, and by extension as long as the Australian dollar is gaining, you can make some assumptions as to whether or not Asia is looking healthier from an economic standpoint.

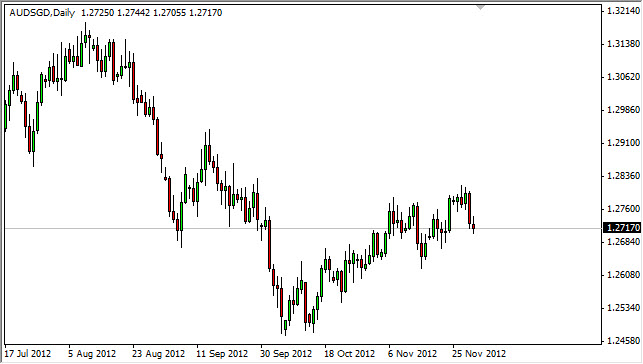

It is a bit of a reach to read too much into this pair, but that is the basic dynamic. With this being said, we have seen a rising channel in this market for the last couple of months, it should be stated that this was right about the time we started to see better economic numbers in general around the world.

To say that we are out of the woods yet is a bit of a stretch, and one has to keep in mind the fact that the Shanghai exchange will print its fourth negative year in a row shortly. However, it does look like the situation in Australia is perking up a little bit, and then of course means that somebody somewhere is starting to wake up.

1.27

I see the 1.27 level as one that should be significant support in this pair. Perhaps the candle from Friday is an illustration of this as he could and break down below that handle at the end of the session. I believe that we will continue the higher climb on a break of the Friday highs, and that the Australian dollar will continue to gain in value against the Singapore dollar.

On a break above the highs from the Tuesday session, this would be the breaking of the top of a shooting star, which is always a bullish sign. I believe if we can get above their, we will hit the 1.30 level before it's all said and done. As for selling this pair, I don't really have a case where I want to be involved in that. If we start to fall, I more than likely will simply pass on it as I see a lot of noise below.