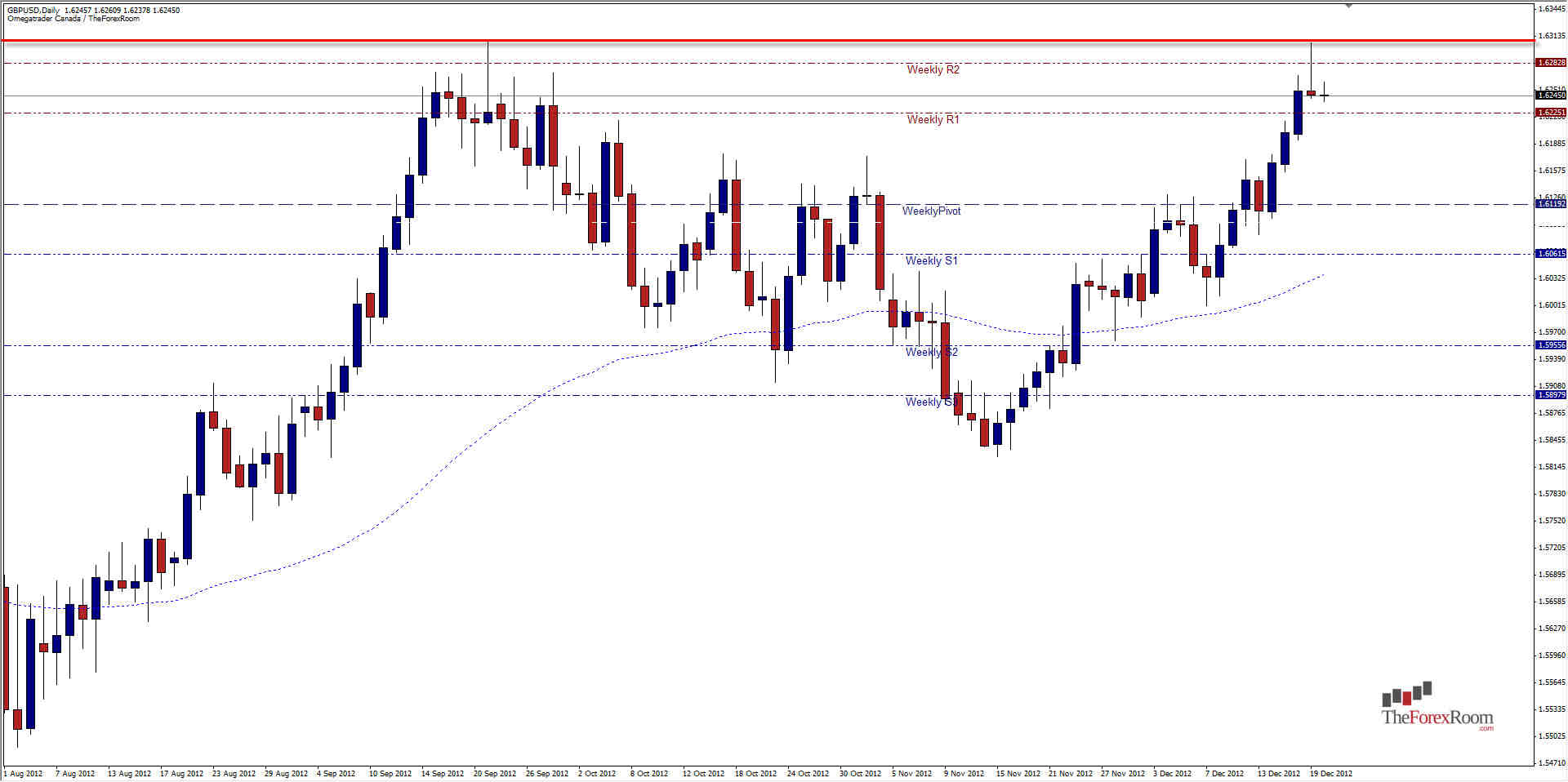

The GBP/USD hit a new 6 month high when it touched 1.6306 yesterday, but has not made a new high for 2012 as of yet. The high was set in September at 1.6309 and yesterday's high marks the third time this year we have tested the 1.6300 level of resistance. Previous to September we had made a high in April at 1.6301 so we now have a triple top on the Weekly charts for the year. Yesterday's price action closed with a Bearish Pin Bar Reversal Candle at this level, and could indicate that we will see prices fall over the next 24 hours if the low at 1.6242 is breached. The Asian low has been 1.6238 which was set immediately after the New York session closed, possibly a residual effect of the american session and might offer a hint towards trader sentiment. Immediate support sits just below the current price level of 1.6249 with the Weekly R1 now acting as support at 1.6225. Breaking 1.6200 will possibly bring a bearish run towards 1.6150 which was a pause point earlier this month as well as back in October and beyond. 1.6119 is the current Weekly pivot offering further support before the Weekly S1 is reached at 1.6062. If price breaks yesterday's high we will be looking for further upside with resistance at 1.6350 and 1.6388. While I believe the overall sentiment of this pair is Bullish longer term, we are in fact due for a bearish correction and the current price level makes perfect sense as the preferred level to perform the correction from. We have been bullish now since mid November more or less and could see a 50% correction down to 1.6066 or 61.8% in extension to 1.6010 before resuming the run of the bulls.

Cable Rejects 1.6300 - Dec. 20, 2012

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup- Labels

- GBP/USD