The EUR/USD pair had a productive and profitable day as the Euro gained against the Dollar after the Federal Reserve announced that it was going to expand its monetary policies far into the future. We already anticipated that the Federal Reserve would do something, but the fact that it now has decided to specific metrics like unemployment gives the market a clear guide as to what they should be doing in the future.

With this being said, the US dollar lost value against most currencies around the world. Of course, the Euro would be no exception during the session, and the pair shot straight up as a result. However, we are approaching significant resistance at this point time, and as a result the next couple of sessions could be very telling.

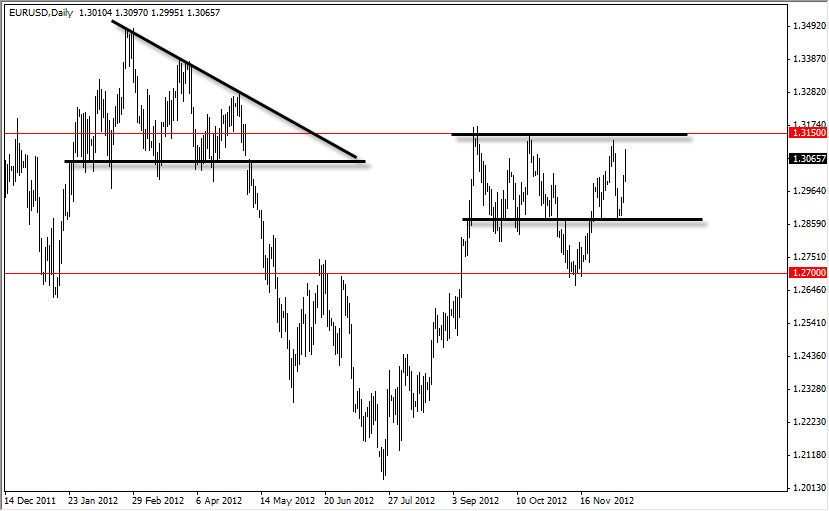

I personally do not believe that we will break above the 1.3150 level; however I am not willing to trade that "assumptions." I need to have it prove to me, and as a result I will be watching the next day or two to see what happens. Candlesticks that look very resistive near the 1.3150 level will be my signal to start selling. I believe that we are essentially bouncing around in a consolidation area at the moment, and as a result will continue to trade this market as such.

Range bound?

This market looks like it's setting up to be range bound between now and the end of the year. I personally see the 1.2900 level as the "floor" in this marketplace at the moment, and it will take significant selling pressure to break below that area. The one this scenario that I can see that happening between now and the end of the year would be the so-called "fiscal cliff" being fired off in the United States. This would more than likely cause a negative knee-jerk reaction in risk assets around the world, causing this pair to selloff.

However, I don't think that the buyers have enough juice to give this pair above the 1.3150 level. Even if they do, I see from the previous descending triangle that had formed this resistance barrier a ton of problems for the buyers above that level. In fact, I see quite a bit of resistance all the way to 1.3500. Because of this, I would be very leery of buying this pair as we plow into that triangle.