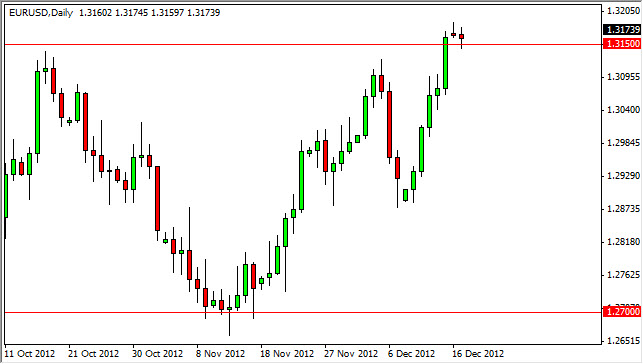

The EUR/USD pair did very little during the session on Monday, but we should note that it has indeed broken out above the 1.3150 level, and this makes sense that we could see a larger move higher. The Friday candle formed a massive green candle, and more importantly closed above the 1.3150 resistance level. At that point time, it became obvious that we were getting ready to break out, and the Monday candle formed a bit of a doji, and it suggests that the market took a rest during the Monday trading hours.

The real question now is whether or not we can get above the recent high at 1.3187. I do believe that we will, and as a result think that buying this pair as long as we stay above the 1.3150 level is the prudent thing to do. I should mention that I see a lot of noise on the longer-term charts all the way up to the 1.35 handle, and as such I don't expect this to be a smooth ride it all.

End of the year

Adding to the potential turmoil is the fact that we are at the end of the year. Low liquidity will plug the markets after a few sessions, and could cause severe moves in one direction or the other. Because of this, you will have to be paying attention to your positions a little more than usual, as a headline crossing the wires could move the market two or three times more than usual.

However, the most likely headline will have something to do with the so-called "fiscal cliff" talks in the United States. If there is a solution to that whole dilemma, expect this pair to rally in response as the "risk on" trade comes back into play.

I do believe that there is a bit of a floor in this market at the 1.29 handle as well. Even if we break down, it's starting to look more and more serious at that area for the buyers. Because of this, I have an upward bias in this pair, even though I think the Euro will face serious troubles in the future.