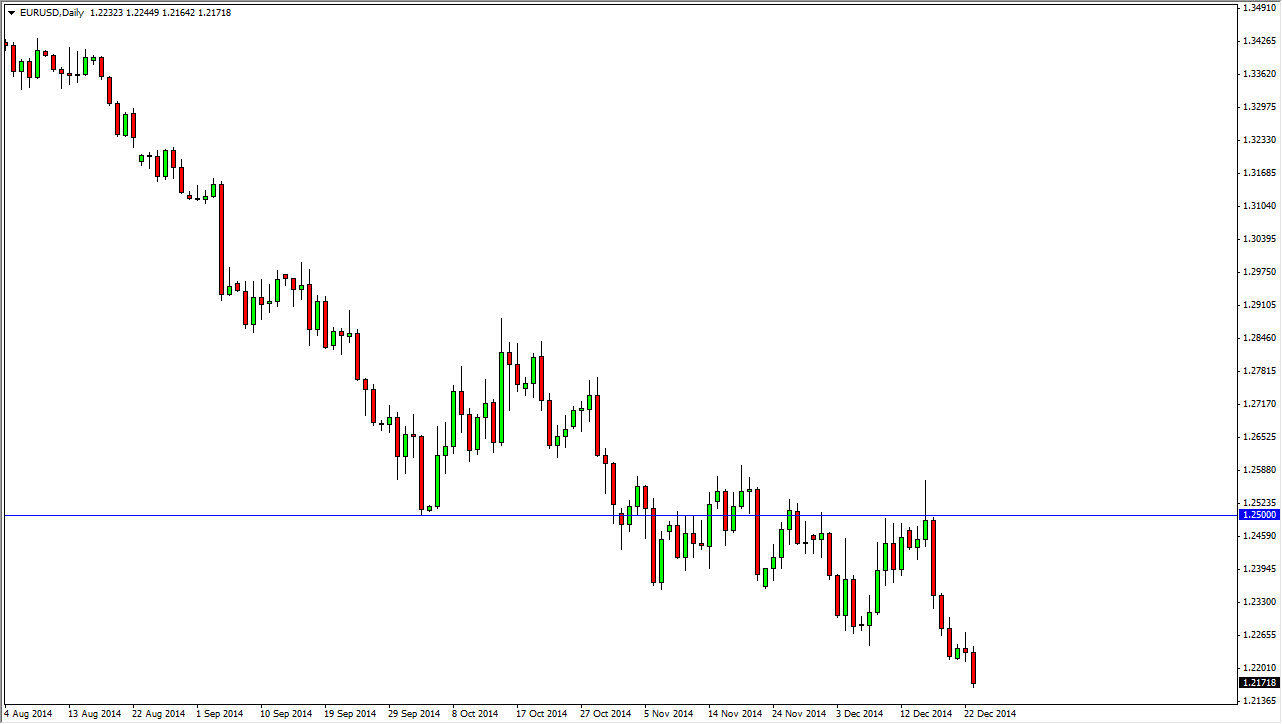

The EUR/USD pair has been one of the more difficult trades to be involved in until recently. I can give you 100 reasons why the Euro should be falling in value, but evidently there are about 105 why the US dollar should be falling at the same time. This is simply a measurement between two currencies that are being debased and devalued, as well as two economies that have major issues at the moment.

The latest action has seen a shooting star on both Wednesday and Thursday, followed by a fall on Friday. However, you will notice that the 1.3150 level which had acted as such fierce resistance previously has now acted as support. It's an interesting pair at the moment, because the weekly candle is actually a beautiful shooting star sitting right on top of the support level. However, over the years I have learned that a lot of times these shooting stars are sitting on top of support are what I call "sucker pins”, with pin being a reference to what Martin Pring calls the "Pinocchio bar." (It should be noted that the "Pinocchio bar" is simply the same thing as a shooting star on a candlestick chart, but shown on the OHLC bar charts.)

It's like a trap

These types of candles a very difficult because they are such great sell signals by themselves, but there is quite a bit of support underneath them. Quite often, I find that these candles in that been broken to the upside, which in and of itself is a massively bullish signal. With this week being very illiquid and holiday trading, I would be very cautious about trying to take this trade unless it was a dead obvious move in either direction.

If we managed to break the 1.31 handle, I would be convinced of that point that this pair is going down to the 1.29 level. Ultimately, a move above the 1.33 handle would be very bullish, and I would expect to see 1.35 in relative short order. Unless we get one of those signals over the next week or so, I will more than likely stay out of this pair to simply because there are too many problems that can come with trading it. I will say though that the fiscal talks going on United States could be a catalyst for this pair to go higher if they get something worked out. Obviously, the exact opposite can be true if they can get it together.