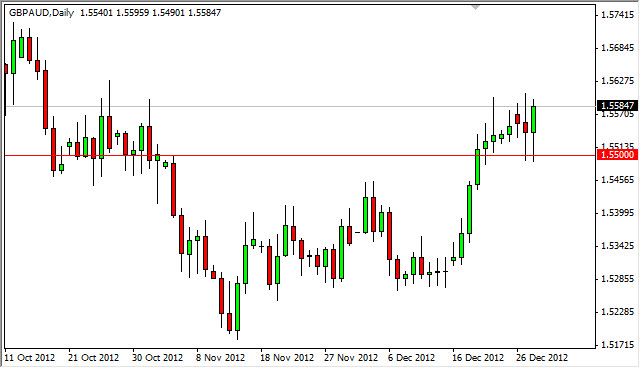

The GBP/AUD pair has spent the better part of the last two weeks bouncing around the 1.55 handle. When look down upon through the prism of the longer-term charts, and this is a significant area, and the fact that we are finding support at this area does suggest that we should see higher prices. This makes sense, as the Australian dollar is by far a much more "risky" currency than the British pound. In other words, it appears that we will start to see a bit of a "risk off" trade in this marketplace if we can continue higher.

I see the 1.56 area just above as the resistance level that needs to be broken in order for the buyers to take over completely. Beyond that, we should see an easy run to the 1.5750 level, and then on to the 1.60 handle.

British pound strength in 2013?

Looking at the longer-term charts against various currencies, it appears that the British pound may be setting up for fairly strong 2013. If this is the case, it should continue to rise against the Australian dollar all things being equal. This may be predicated upon the idea that the bank of England is been so stubborn about expanding its monetary policy while other central banks in Europe, the United States, and Japan all are ready to ease their monetary policy hand over fist.

In a roundabout way, the British may actually be "losing" the race to the bottom. There are various central banks right now trying to kill off their own currencies, while the British are doing the completely absurd thing of actually trying to keep their currency somewhat viable. (I am of course being sarcastic here.)

Looking forward, if we can get above the 1.56 level I see no reason to think why we can go as far as 1.60 before the move runs into serious resistance. This pair does tend to move rather a radically over time, and does grind for quite a while before making these moves. If you know this ahead of time though, you can be as patient as you need. As for selling, a severe break down below the 1.55 handle would be enough to suggest that we may be heading back towards 1.53 or so.