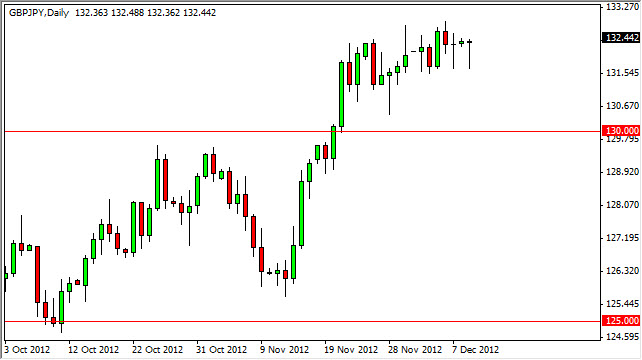

The GBP/JPY pair is typically a big mover, which is kind of ironic as we have seen very little volatility in this currency pair over the last couple of weeks. This may be because of the massive move higher we saw over the last couple of weeks in November, and the fact that the buyers they simply need to rest.

With more interesting is the fact that we broke above the 130 level, which on the longer-term charts is an obvious support and resistance area. We have formed several hammers along the way, and as a result it does look like there is a certain amount of support for this pair. The most recent hammer of course was the Monday session, and as a result I believe that this pair is winding up to go higher.

The Bank of Japan is working against the value of the Yen, and an election when buying the opposition leader Mr. Abe should put even more political pressure on the Bank of Japan to continue to purchase assets, and expand that program massively. Because of this, the value of the Yen should continue to decline over time unless of course some type of financial meltdown.

130 could be the floor

Looking this chart, I believe that the 130 handle could be the floor going forward. We are about 250 pips above it right now, and this pair does tend to favor buying as the swap is most certainly positive. I believe that this will be one of the more exciting pairs to trade in the year 2013, simply because I believe that the Yen will continue to disintegrate over the next year or so.

Going forward, I believe that as long as we or over the 130 handle we will be in a situation where buying the pullbacks will be the way to go. I also believe that if we can get above the 133 handle that we will continue higher and aim for the 135 handle in short order. As for selling, I have absolutely no thoughts on doing so until we get well below the 130 handle on a daily, if not weekly close.