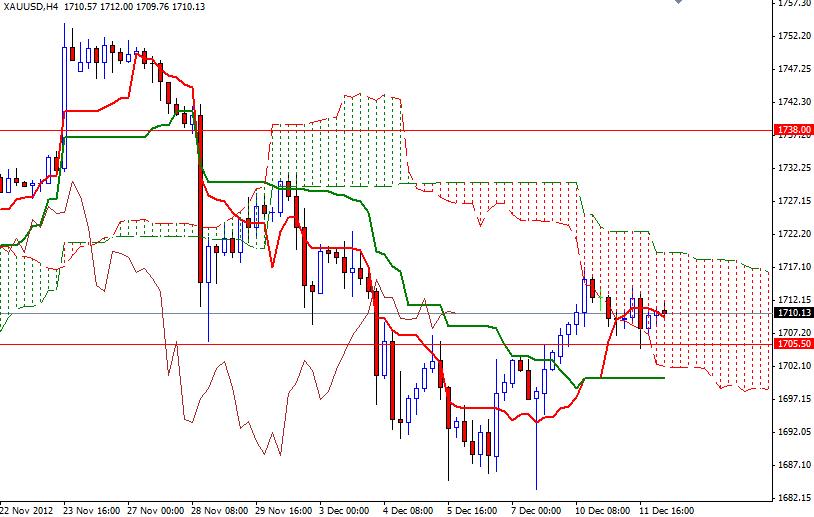

XAU/USD is consolidating in a relatively small range during the Asian session today. Yesterday XAU/USD found support at the 1705 level as the American dollar remained under the pressure on expectations the Federal Reserve will take further monetary easing steps. The recent price action shows that investors want to see the outcome of a two-day meeting of the Federal Open Market Committee meeting which started yesterday. The minutes of the latest meeting had indicated that the policy makers have no intention to relax its easing stance. Therefore market participants expect the Federal Reserve to expand its asset purchases program which expires at the end of the year. If the Fed announces a new round of stimulus, this would be positive for gold as printing more money will devaluate the American dollar. However if the Fed disappoints the market i.e. delays the program or announces a small size, we may see a strong reaction. Meanwhile, gold charts paint a mixed technical picture. Prices are above the Ichimoku cloud on the weekly time frame but the daily chart remains bearish and on the 4-hour chart the pair is inside the cloud.

Year-end profit taking and light volumes may stop investors from opening big positions. I think we the sentiment will remain bullish as long as XAU/USD trades above the 1700 level. If the 1714 level gives way, look for 1718.83, 1725.75 and 1732. In order to confirm a bullish trend look for prices to close above 1725.75. If XAU/USD encounters heavy resistance and reverses, support will be found at 1705, 1700 and 1685.