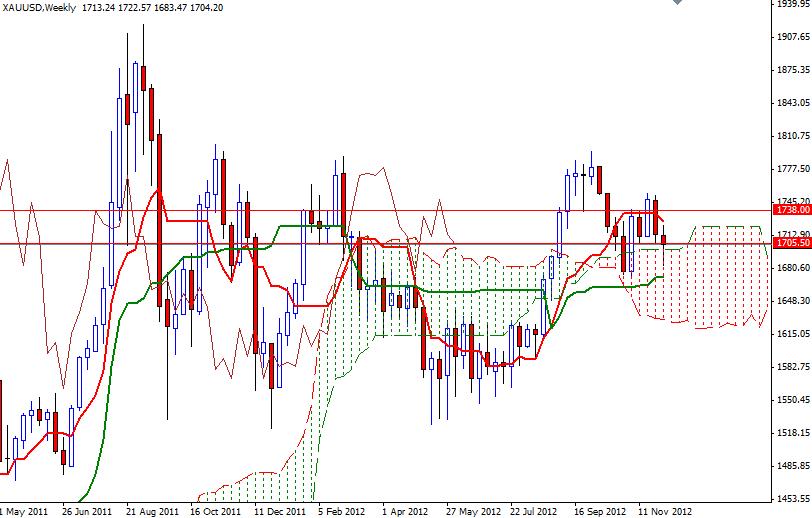

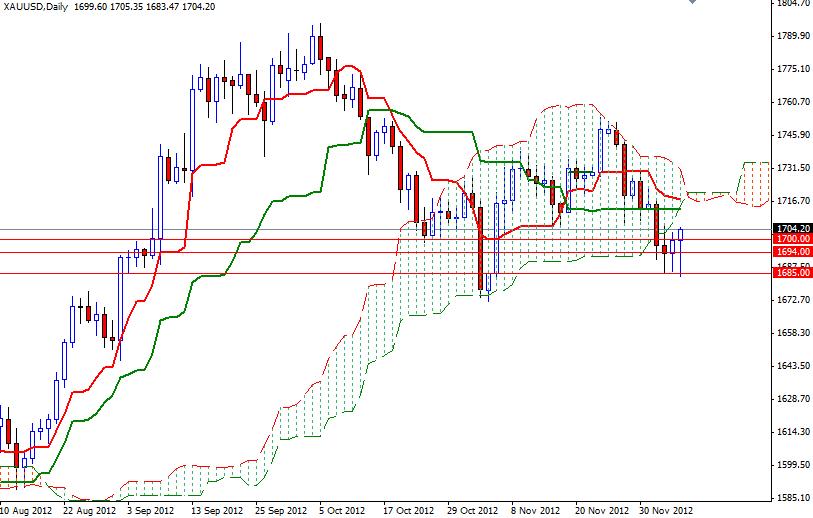

XAU/USD turned bullish after the bears failed to break the 1685 support. Although gold prices ended the week lower, the recent price action suggests that the bulls will not give up so easy. It seems that XAU/USD has pulled itself out of the bears grip but whether we have a retracement developing or start of a bullish trend is hard to tell at this point. With continued volatility in the gold markets, it may be hard to build a long-term position. XAU/USD still gives us a mixed picture as prices remain different sides of the Ichimoku clouds on the daily and the weekly charts.

The main event clearly will be the Federal Open Market Committee meeting and Chairman Bernanke’s press conference on Wednesday. There are rumors that the Federal Reserve is going to announce a new bond purchase program to replace Operation Twist program which expires this month. Although some analysts think the Friday’s jobs data may convince the Fed to opt for a smaller program, I think the Fed will continue its aggressive stance until it reaches its target (a sustained monthly increase in jobs of 200K per month). If the Federal Reserve keeps using economic stimulus to bolster growth, that would be negative for the American dollar. I believe the market is pricing in this expectation. I expect a bullish sentiment ahead of the Fed meeting. Technically speaking, if the bulls break through the 1705 resistance level, they will be heading towards the 1738 level. On its way up, expect to see resistance at 1713.38, 1720.88 and 1726. However, a daily close below the 1685 support level would suggest a real momentum shift to bearish price action. Support to the downside can be found at 1700, 1694 and 1688.57.