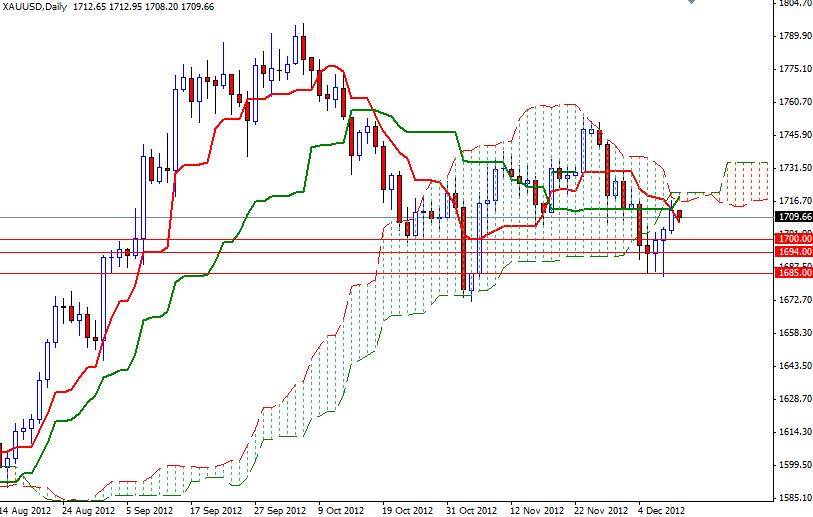

XAU/USD (gold vs. the greenback) rose three days in a row. The pair printed a bullish candle yesterday on better-than-expected data from China and worries over the U.S. budget battle. Gold prices are also supported by expectations the Federal Reserve will expand monetary stimulus and continue bond purchases of $45 billion/month. Yesterday, the pair traded as high as 1717.17 which was the lower line of the Ichimoku cloud on the 4 hour chart and today during the Asian session prices pulled back to the Tenkan-sen line (nine-period moving average, red line) at 1709. Ichimoku clouds represent resistance ahead of us. Therefore we may revisit the 1705.50 support level first.

Although the current outlook remains bearish according to the daily chart, XAU/USD may make another attempt to pass through the clouds if we find strong support in the 1705.50 – 1700 area. From an intraday perspective, look for resistance at 1713, 1719.49 and 1725. If price can push back up and close above the 1725 level, we might see a bullish continuation targeting 1738 at least. If the bears take over and XAU/USD breaks below 1700, we could see more speculative selling pressure coming. If that is the case, support can be found at 1694, 1688.50 and 1683.50. A bearish close below 1683.50 will likely mean a stronger bearish push downward and I wouldn’t be surprised to see price hitting 1672 in a very short time.