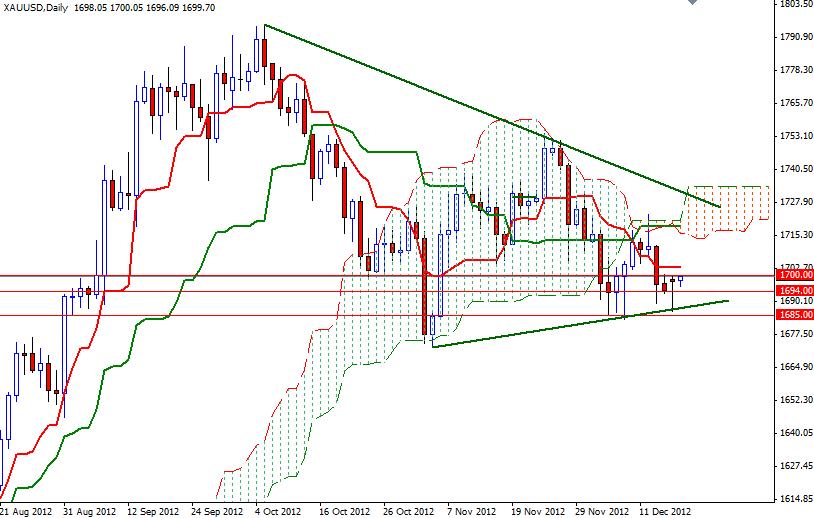

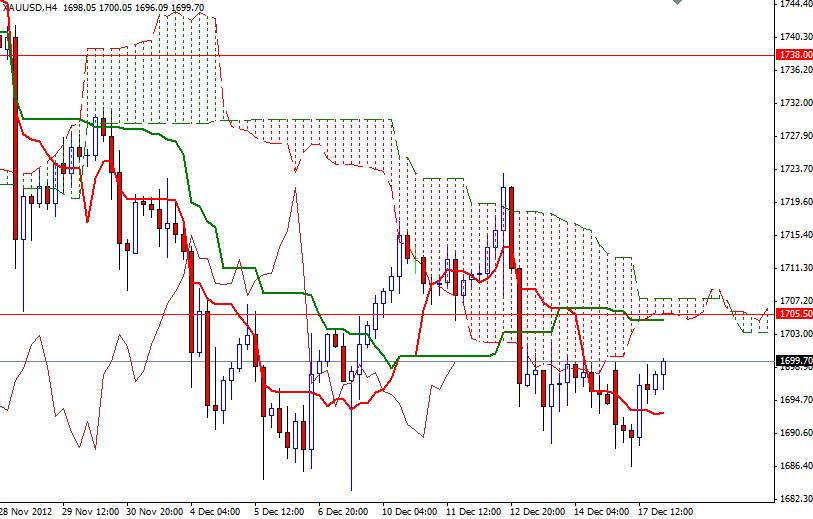

XAU/USD bounced off of the 1686.40 level and printed a hammer on the daily chart. This level converges with the bottom line of a giant triangle which the pair has been forming since October. XAU/USD turned bullish as the American dollar weakened after the manufacturing activity data released from the United States came out worse than expected. The data showed the Empire State Manufacturing Index fell to -8.1 from -5.2. While prices are under pressure as the market participants wait the outcome of the U.S. budget negotiations, the market volume is decreasing. I think we will remain inside the triangle as the markets simply have no real catalyst to push prices in either direction. Meanwhile the key levels to watch will be 1700 and 1685. Although monetary easing around the world should support gold prices in the long-term, the upside may be limited with players taking profits to close their books before leaving for the New Year holidays. On the daily time frame XAU/USD is still below the cloud and the Tenkan-sen line (nine-period moving average, red line) is moving below the Kijun-sen line (twenty six-day moving average, green line). However, there is a support forming at the 1686 level.

If the bulls manage to break and hold above the 1700 barrier, look for 1705.50, 1712.60 and 1718.83. However if the bears win the fight and the pair continues to fall, support will be found at 1694, 1686 and 1676.