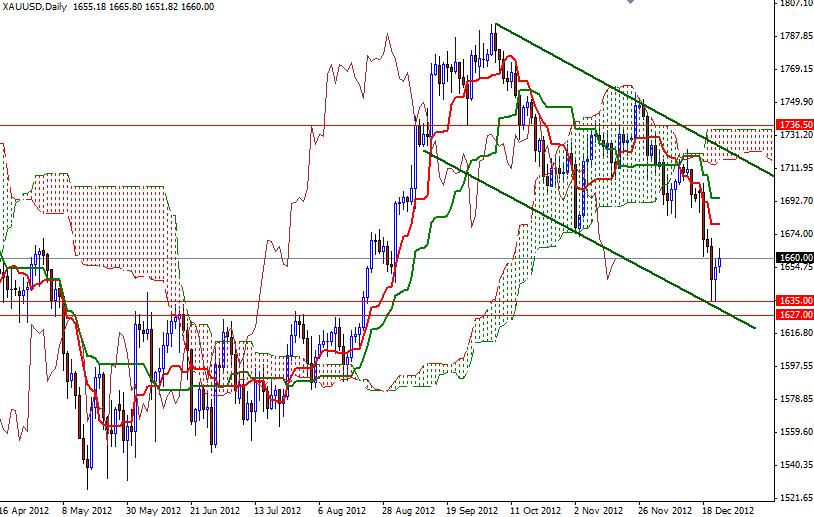

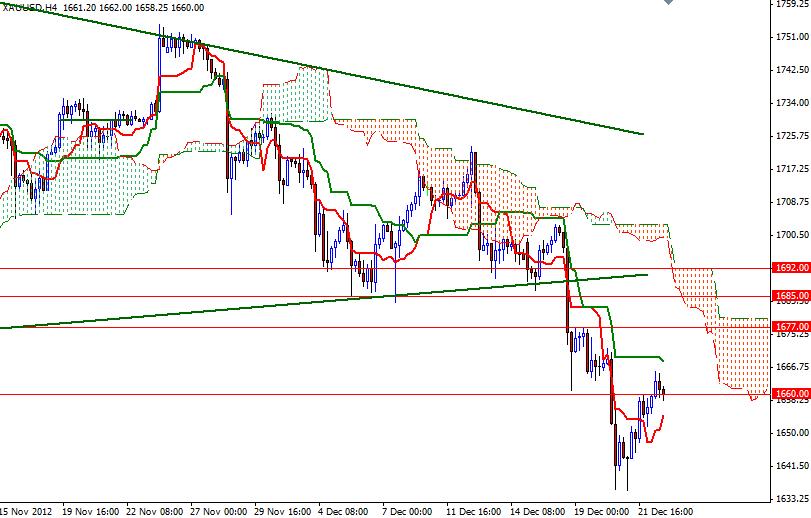

XAU/USD closed slightly higher than opening but activity was subdued, as trading closed early ahead of the Christmas holiday. The XAU/USD pair (gold vs. U.S. dollar) traded as high as 1665.80 and settled at 1660. Lately falling prices put the precious metal back in the spotlights. There are lots of ideas and predictions on future gold prices and I think the gold market will remain choppy for the next few weeks. At the moment, investors remain focused on talks between the Democrats and Republicans as the fiscal cliff is the only thing that is important for markets. Despite the fact that negotiations failed last week, some people still hope for a miracle solution before the time runs out. Although there are several reports saying the central banks, especially in the emerging countries, have been increasing their gold reserves, these are long term investments. I believe the central banks will continue to increase the proportion of gold in their reserve assets during next year but right now it is hard to tell that we have seen the bottom. Looking at the charts from a purely technical point of view, I think XAU/USD will continue to trade within the descending channel. 30-minute and 1-hour charts confirm that prices may climb higher. However, on the daily and 4-hour time frame, prices remain below the Ichimoku cloud and we also have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses.

The 1710/20 area will be the key to the upside. A close above that level would indicate the bulls are firmly in control once again. To the upside, there will be resistance at 1666, 1677 and 1685. Support to the downside may be found at 1647, 1651 and 1635.