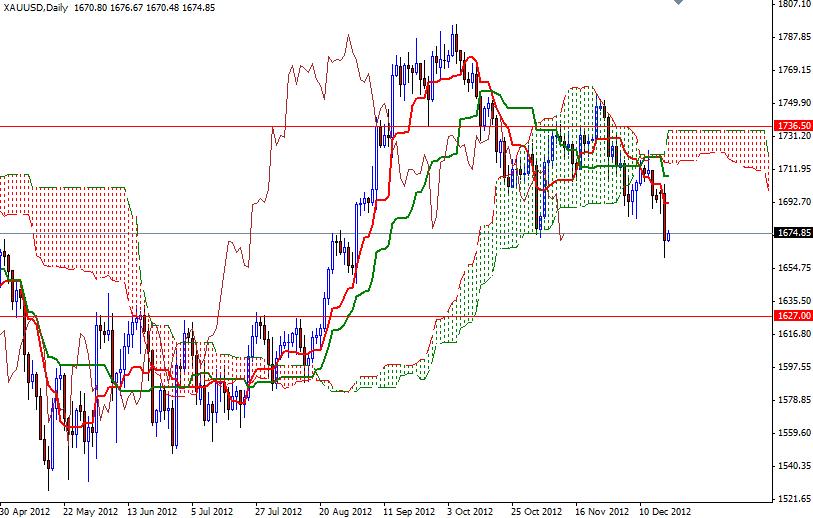

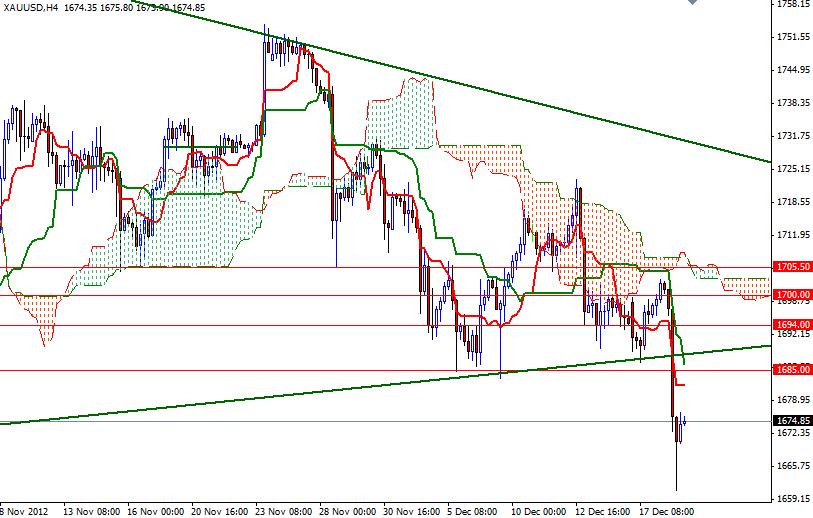

Gold prices fell hard yesterday after media reports that President Barack Obama made a new offer to House of Representatives Speaker John Boehner to avoid a U.S. fiscal cliff of spending cuts and tax rises in January. XAU/USD (gold vs. the American dollar) traded as low as 1661 before retracing back to 1674. The U.S. budget negotiations have been driving the gold market’s bearish activity. The recent price action shows that progress in negotiations will continue to weaken interest in gold. I also believe that low market volume and year-end profit taking will be negative for the precious metal. Looking at the charts from a purely technical point of view, the odds favor further drop. Prices remain below the Ichimoku cloud on the daily and 4-hour time frames.

In addition, we have bearish Tenkan-sen line (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) crosses on both charts. Also Chikou span (brown line), which broke below the clouds, indicate lower prices will come. Selling is still preferred overall though, and signs of weakness are what I am looking for. The general outlook will remain strongly bearish at least the pair closes above 1720. If the bears manage to break below yesterday’s low, the next targets will probably be 1646 1640 and 1627. Resistance to the upside will be found at 1683, 1692 and 1700.