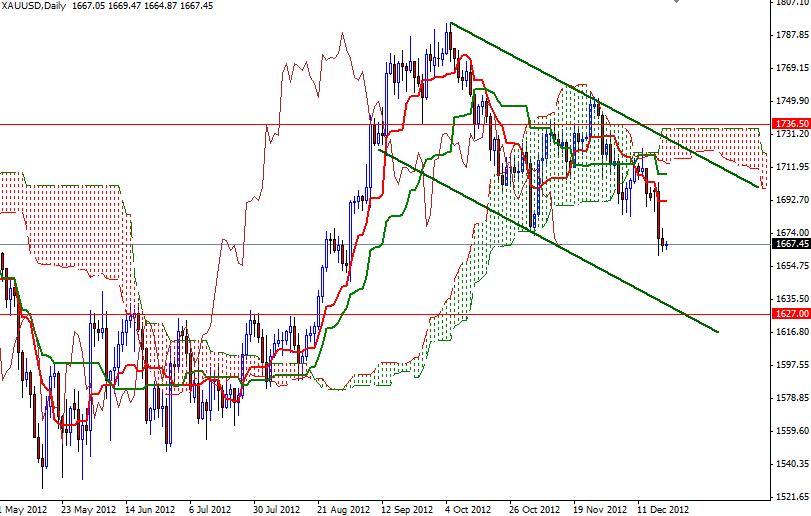

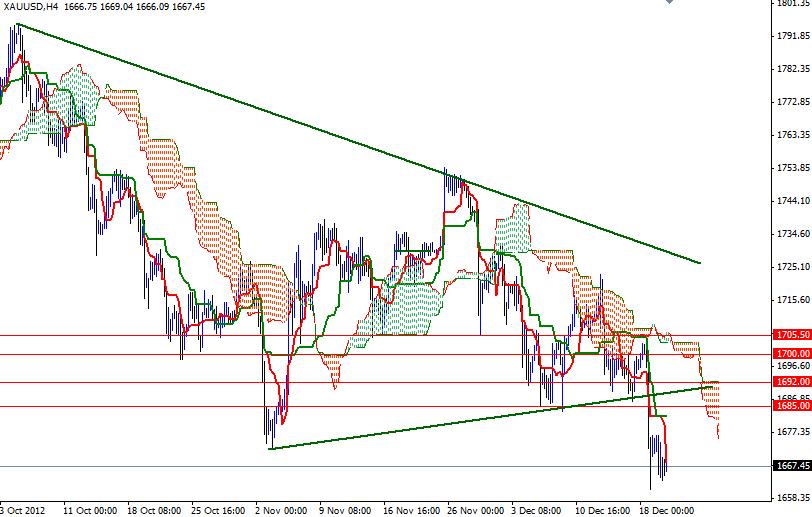

XAU/USD continued to slide and closed lower than opening yesterday. This was the lowest settlement price since August 30. XAU/USD has seen quite a selloff lately, as the conditions in the marketplace have dulled the precious metal’s safe-haven appeal. Lack of volume and strength behind the bulls could be another factor. Considering the fact that gold prices were around the 1563 level almost one year ago, I believe we feel the pressure from profit-taking as big investors lock in gains before year’s end. Gold prices have been falling since October when the pair peaked at 1795.52. Now we returned to the previous consolidation area which trapped the pair for a week in August. This is quite possibly just a short term consolidation before a break lower towards the next support zones of 1652 and 1645. The key levels to watch today are located at 1660 and 1677. The daily and 4-hour charts are still bearish as prices remain below the Ichimoku cloud. The Tenkan-sen line (nine-period moving average, red line) is moving below the Kijun-sen line (twenty six-day moving average, green line) on both time frames.

If the bears continue to dominate the pair and drag prices below the 1660 level, we may see another sell-off which will target the 1627 level (the bottom line of a descending channel). On its way down, expect to support at 1651, 1645 and 1638. However, if the bulls take over and push the pair above the 1677 level, we may see prices climbing towards the ascending trend line which was broken 2 days ago. To the upside, resistance may be found at 1685, 1692 and 1700.