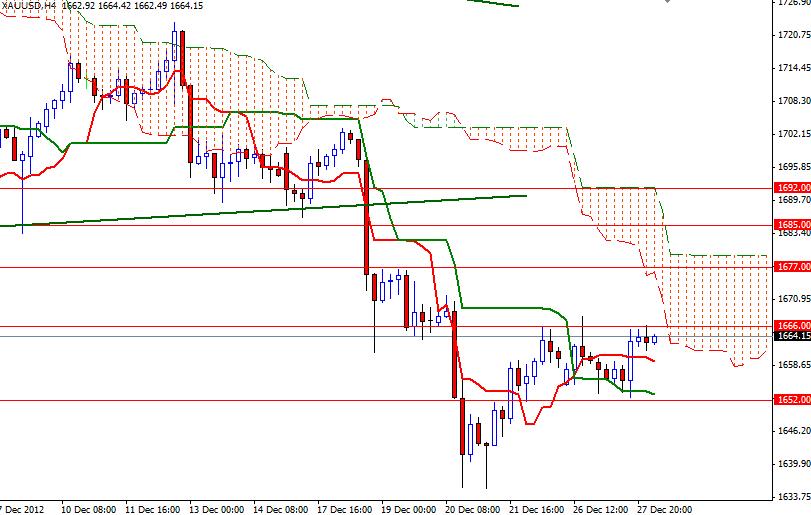

The gold market remains focused on the U.S. budget battle. Yesterday the XAU/USD pair closed higher than opening on increased uncertainty that lawmakers in the United States will reach a budget deal before next year. XAU/USD hit the 1666 resistance but failed as the USD bulls gained some strength after the report released by the U.S. Labor Department revealed initial jobless claims dropped by 12K to a seasonally adjusted 350K. While there are reports saying Obama’s administration is considering options on the budget and planning to extend expiring tax cuts, the time is running out. Right now, no one knows what deal will be struck in the U.S., or when it will be struck. The pattern on the charts suggests we are going to be range bound in the near term.

Although prices have been rising slowly but steadily since we touched 1635, the bulls would need more strength and volume to break through the strong resistances ahead. If the bulls can build some steam up and get a close above 1666, I believe we will see more strength. However, there is a strong resistance at the 1677 level. The bulls will need to push prices above this level in order to gain control. Above 1677, look for 1685 and 1692. If the bears take over and XAU/USD continues its bearish sentiment, expect to see support at 1658, 1652 and 1647. A weekly close below 1652 could take us back to the 1635 level.