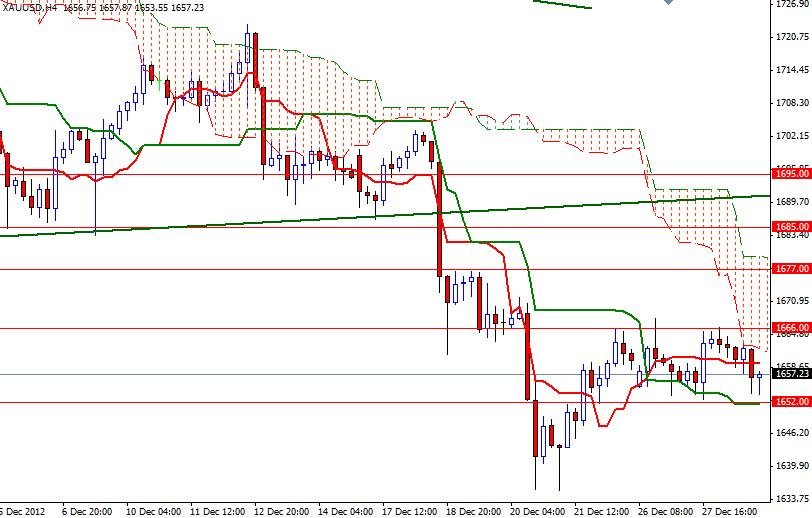

XAU/USD printed a bearish candle on Friday but rose slightly on a weekly basis. It appears that prices established a support level at 1652 and a resistance at 1666 as market players are paying attention to U.S budget talks to see if lawmakers can reach a deal to avoid a series of spending cuts and tax hikes beginning on January 1st 2013. Weakness in the American dollar helped XAU/USD to pause its recent freefall. However, the uncertainty in the market and lack of volume caused prices to consolidate in a relatively tight range. We are down to the final hours of fiscal cliff negotiations.

Although Senate Majority Leader Harry Reid and Minority Leader Mitch McConnell said Democrats and Republicans are trying to reach a deal before the deadline, they will probably focus on a narrow range of issues. A last minute interim accord probably will create a sense of relief in the market but that means negotiations to raise the U.S. debt ceiling and reduce the overwhelming debt will continue to influence investor sentiment. In addition, the rating agencies may react negatively. If XAU/USD breaks through the 1666 barrier, this could start a bullish run towards the 1694.87 level which is the Kijun-sen line (twenty six-day moving average, green line) on the daily chart.

To the upside, expect to see more resistance at 1677 and 1685 levels. On the other hand, a close below 1650 would suggest that the bullish run will have to wait a little longer. In that case, look for 1647, 1643.50 and 1635.