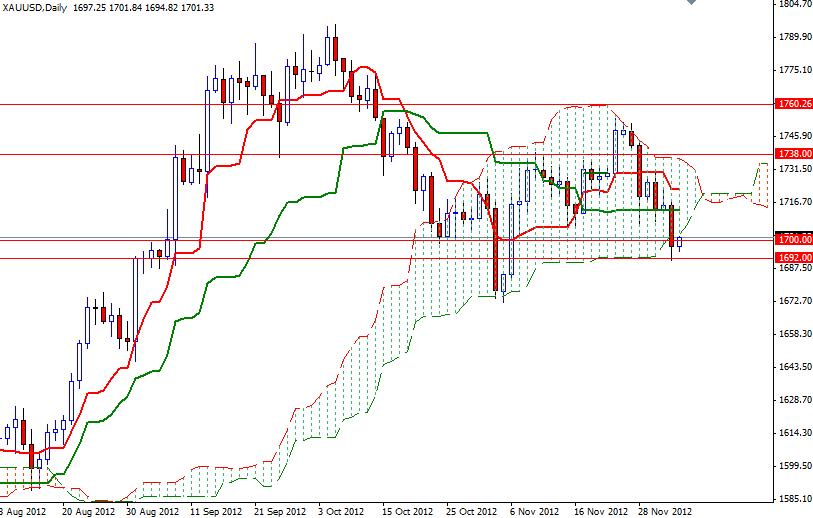

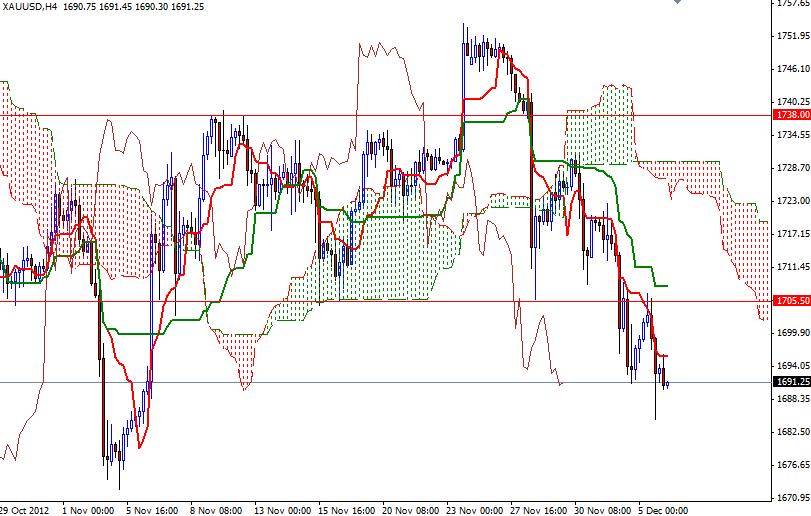

XAU/USD continued to sink yesterday as strength in the American dollar helped sellers. Demand for the greenback increased after data on U.S. services, factory orders beat estimates and President Obama said “a fiscal deal is achievable in about a week if republicans acknowledge the need to raise taxes on the wealthy”. The Institute for Supply Management’s Non-manufacturing index rose to 54.7 in November from 54.2 in October. Also there were reports saying a weaker price forecast by Goldman Sachs triggered some fund liquidation. Today sees release of several important economic reports such as Unemployment Claims as well as Central Bank rate decisions, so expect some volatility. I think the headlines on the fiscal cliff and any headlines on the ECB’s growth forecasts will be dominating the market reaction. XAU/USD is trying to climb above the 1692 level during the Asian session but this area has produced a bit of a bounce so far.

If the fall does stop at this level and price turns bullish, look for resistance at 1700 and 1705.50 before heading back up to 1713. A close back above the Ichimoku cloud (1720.88) could be the first sign showing that the momentum is once again turning bullish. Until that happens, the bears will be in charge. If the downward pressure continues and we break below the yesterday’s low, look for support in the 1676.65 area, then 1671.84 and again at 1657.