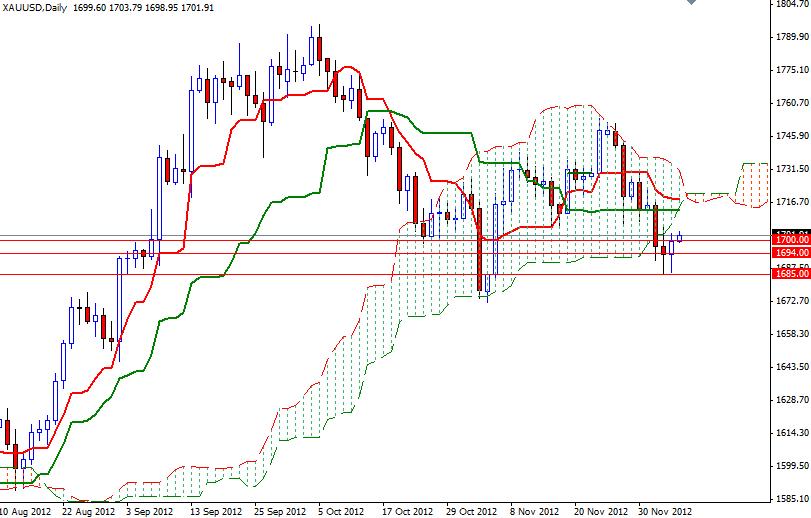

XAU/USD halted its decline at the 1685 area after two consecutive days of losses. The pair turned north after European Central Bank President Mario Draghi said the ECB left the its monetary policy unchanged but Governing Council members had a wide discussion on interest rates, leaving the door open for an interest rate cut early in 2013. The ECB cut its 2013 forecast from 0.5% growth to a contraction of 0.3%. Gold prices climbed roughly $19 on possibility of additional easing by the central bank.

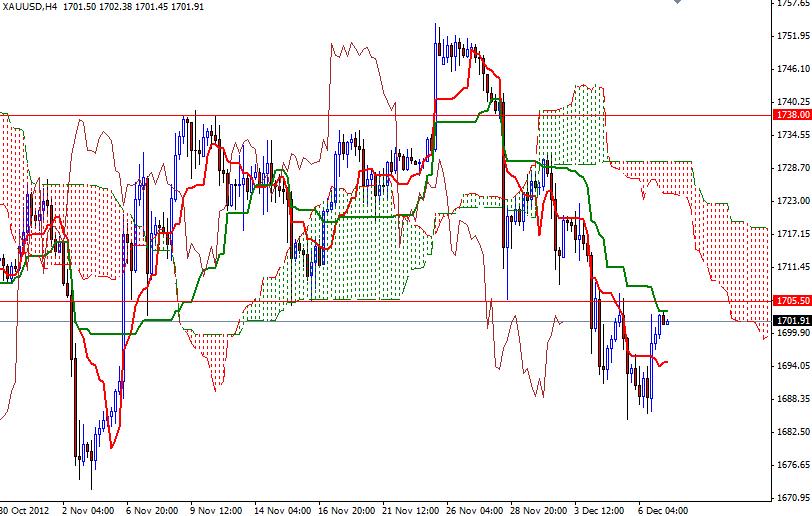

Today the market participants will be focusing on the U.S. nonfarm payrolls data. A soft number would boost speculations that the Federal Reserve will expand its third round of quantitative easing at its December 11-12 meeting. Although XAU/USD found support at the 1685 level, the pair has to push its way through the 1700-1705 resistance zone in order to gain some momentum. The real challenges will be waiting the bulls at the 1712 level where the bottom line of the Ichimoku cloud and the Kijun Sen line (twenty six-day moving average, green line) converge on the daily chart and at the 1720.50 level which is the upper line of the cloud.

A close above the 1720.50 would be enough to push XAU/USD to 1738. If the bulls fails to breach the 1705 level and prices reverse, expect to see support at 1694, 1685 and 1677.