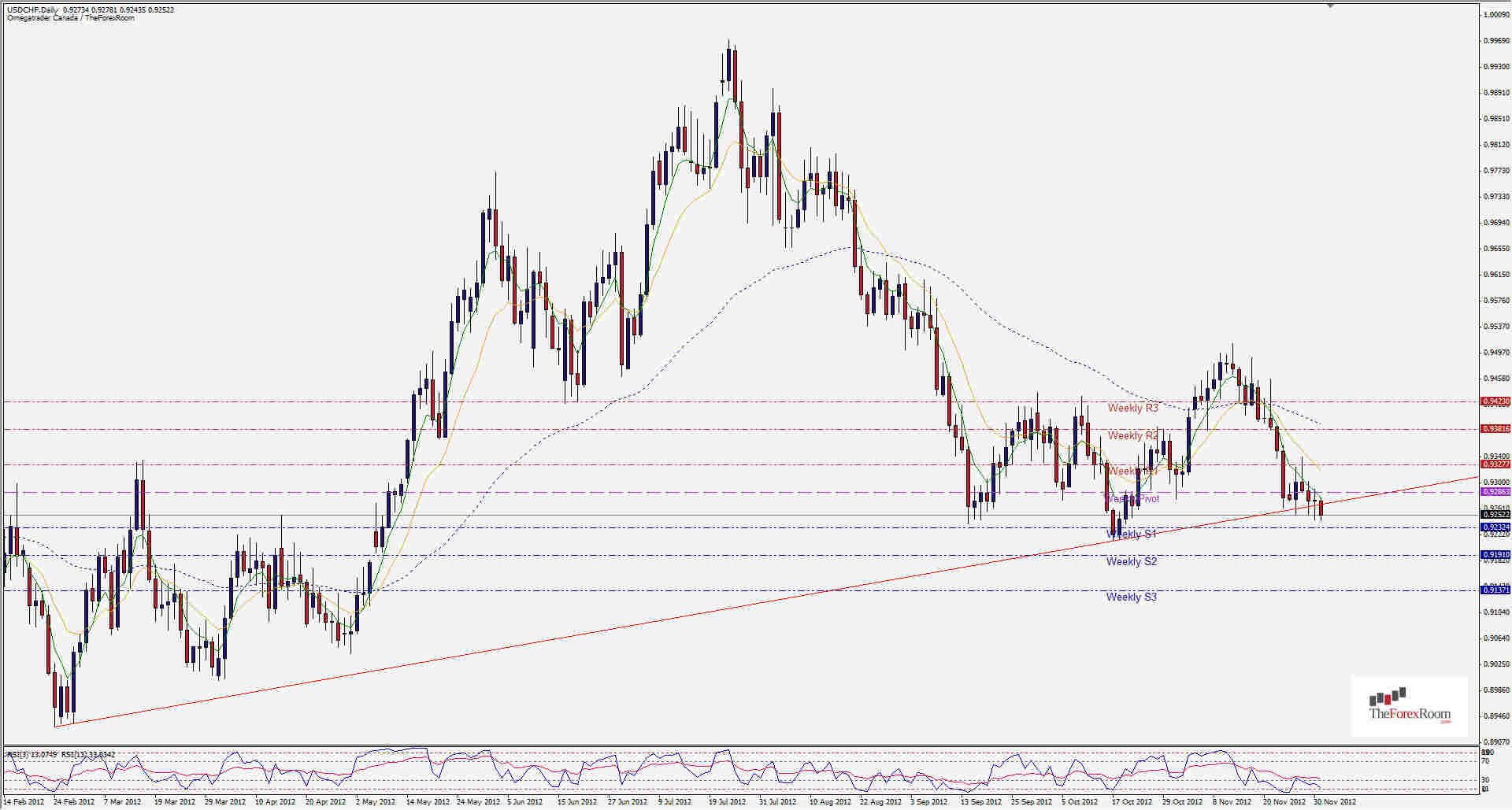

The USD/CHF, aka Swissy is at a key area of support just as the EUR/USD is at a key level of resistance. The pair is sitting on a zone at roughly 0.9250 as the Asian session winds down, having come within only a few pips of last week's lows already, there appears to be a solid chance that the currency pair might shear this support level and head lower. It has already broken an ascending trend-line 2 days in a row but is yet to see a daily close below the trend-line of support at 0.9267.

With the Monthly & Weekly charts both bearish, and moving average crosses on both to the downside, this could be the line in the sand for the pair. Support below is frequent including intraday support levels of 0.9248, 0.9224 & 0.9202. Weekly and Monthly levels can bee seen at 0.9232/0.9175, as well as 0.9140 and 0.9075. If prices reach as low as 0.8900, there is a technical vacuum below that could potentially suck the pair all the way down to 0.7100 again, prices not seen since July 2011. Below 0.8900 there are very few levels of strong support except maybe 0.8475. To the upside, which some believe is the more likely scenario with the USD confident that an agreement to minimize the effects of falling over the Fiscal Cliff is imminent, and that so many are talking about, we could see a return to 'risk on' appetites and force this pair higher and the dollar lower. In that scenario, we will be looking for resistance at 0.9286, 0.9327 and 0.9382. A close above 0.9500 on a daily chart could see this pair shoot up to the August lows of around 0.9700 as well.

Happy Trading!