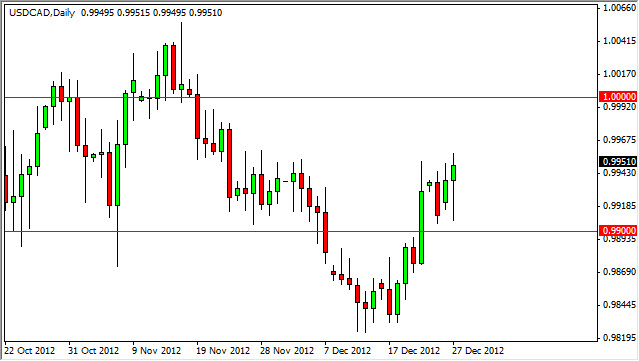

The USD/CAD pair fell during the Thursday session, and bounced off of the 0.99 handle. This is an area that I suspect it could as the area has been supportive. The fact that we closed the day forming a bullish hammer suggests to me that we will make a run towards the 0.9950 level which I see as massive resistance. In fact, I think if we break above that there is a good chance that we will continue much higher and above the parity level.

Parity will be an area that shows resistance. However, the real resistance is at the 1.0050 level. If we can get above that area this pair will continue to climb. Looking at this chart, it should react to what's going on with the fiscal talks in the United States. Simply put, if we have very bad news this market will skyrocket as the Canadian dollar will be punished as a "risk on" currency. Also, this could throw the United States into a recession, and then of course would be bad for Canadian exports.

Choppiness

Even if we get some type of significant move in this pair, it's difficult to think that it won't be choppy. This market has been choppy historically, and the fact that the two economies are so intermingled lends itself to be likely to continue this. I personally believe that this will be one of the great trades going forward once we decide a direction in the marketplace overall. After all, this pair is done very little over the last several months.

My suspicion is that we will more than likely see a move up, followed by a plunge down. This will all be predicated upon headline news, and as a result this pair could give a little bit to both buyers and sellers over the next couple of weeks. The downtrend in this pair is pretty solid from a longer-term perspective, and unless we see some type of absolute cratering of the economy and that should not change. If they finally get the so-called fiscal cliff talks settled with an acceptable arrangement, this pair should continue to grind much lower.