The USD/CAD pair fell during the session as the Federal Reserve announced that it was extending quantitative easing out into the future. The bond buyback program was sent to and at the end of this month, and the fact that the Federal Reserve is willing to extend that should continue to keep interest rates rather low.

This is essentially the same thing as printing Dollars, and as a result the US dollar weakened against most currencies worldwide during the session on Wednesday. The USD/CAD pair typically will fall if a more "risk on" attitude enters the market. This is exactly what happened during the session, and as a result we solve the Monday and Tuesday shooting stars become somewhat of a self-fulfilling prophecy as market plunged.

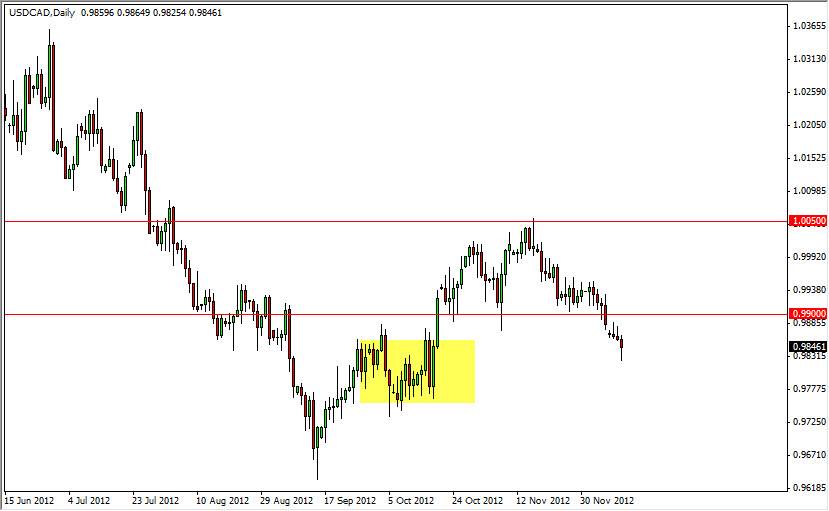

However, we got a bit of a snapback later in the day, and the Wednesday candle shows a significant bounce. I suspect this is because of the cluster of price action back in late September that we are just now starting to plow into. With this being said, I expect this pair to grind lower, not meltdown.

Oil at support as well

In the oil markets look like they are finding support now as well and as a result we should see a continued bid for the Canadian dollar. Also, let's not forget the fact that the Canadians produced a dynamite employment number last week, and as such it does look like the Canadian economy is doing quite well.

There is a bit of an interest rate swap differential here, albeit small. But in a world where the bonds simply do not pay much, every little bit helps. Because of this move, I suspect that we will eventually find the 0.97 level in this currency pair. I don't a silly think this will happen right away, but it will turn be a bit of a grind lower as stated above.

As for buying, I would have to get bullish if we managed to get above the 1.0050 level, an area that we simply cannot seem to get over. Until that happens, I'm simply selling this pair on rallies, and brakes of the low from Wednesday.