The USD/JPY pair continues to be one of my favorite trades at the moment as I see such a lopsided opportunity. The Bank of Japan looks set to continue printing Yen into the foreseeable future, and this will be especially true if the opposition leader Mr. Abe wins the general election, which is something that he is expected to do. After all, he did state that he once the Bank of Japan to print "unlimited Yen” in order to help the export sector of the Japanese economy. While he has no direct say in what the central bank does, he certainly can put a lot of political pressure on them.

There is also talk of an inflation target of 3% out of Japan, which is something that they are far below at the moment. Both of these things mean a weaker Yen is absolutely vital. With this in mind, it looks like the Bank of Japan will finally get its wish and see this pair go higher.

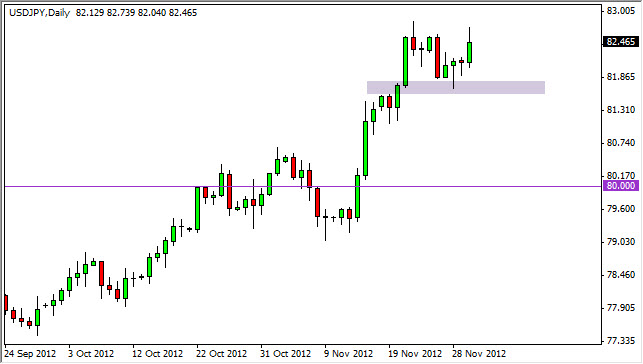

84

The 84 handle is without a doubt one of the most important spots on this chart as far as I can tell. This is because it is the last vestiges of resistance in this general vicinity, and if it gives way to the buyers we could see significant upside in this market. In fact, I believe that we will see a print of 100 sometime during 2013.

This isn't to say that it will be a straight shot higher, it obviously won't. However, the cards are lining up for significant move in this pair in the Forex world seems to be pretty excited about it. With that being said we could get quite a bit of momentum in one shot and wake up one morning to find this pair up 300 pips. This will likely be predicated upon headlines out of Japan, and we think that they could be coming sooner than a lot of traders are aware of. The illiquid trading conditions around the holiday season can also offer a catalyst for this type of movement. I am already long this pair, and am looking to add to it significantly above the 84 level.