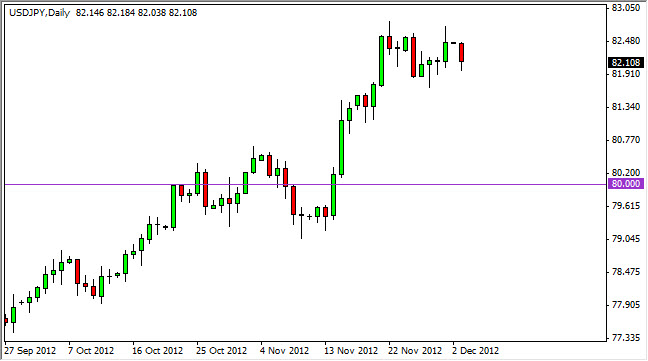

The USD/JPY pair fell during the Monday session as we continue to struggle with the 82.50 resistance level. However, over the long term I do believe that this pair will continue to go higher, and I also think that the Wednesday hammer from last week shows that there is significant support at the 82 handle overall.

Going forward, I believe that any time this pair falls it is a buying opportunity. You have the Bank of Japan on one side of the equation that looks hard-pressed to do anything but print Yen going forward, especially if Mr. Abe becomes the Prime Minister of that country. He has already stated in the papers that he wants the Bank of Japan to print "unlimited Yen" in order to trying to devalue the currency as exports have suffered over the last several years of inordinate Yen strength.

80 is the floor

I still believe that the 80 handle is essentially the floor of this market right now. More portly though, I see 84 as a massive resistance area that needs to be overcome in order for the buyers to take complete control. I do think this will happen eventually, and it is only a matter of time.

At the moment, I think that anytime this market falls and shows any type of support it is a good time to buy. I see actually no scenario where I want to sell this pair or more to the point - by Yen - and as a result I am simply adding to my position in very small increments going forward. It takes quite some time to reverse and overall trend, and I do think this is what's going on right now. However, we could be going through this for weeks if not months going forward.

If we do get above the 84 handle, I do believe that this is a buy-and-hold market going forward, and this could be the "career making trade" for several Forex traders out there. The only question is whether or not you have the fortitude to hang onto the market as a child's around. This is why I am adding in very slow increments.