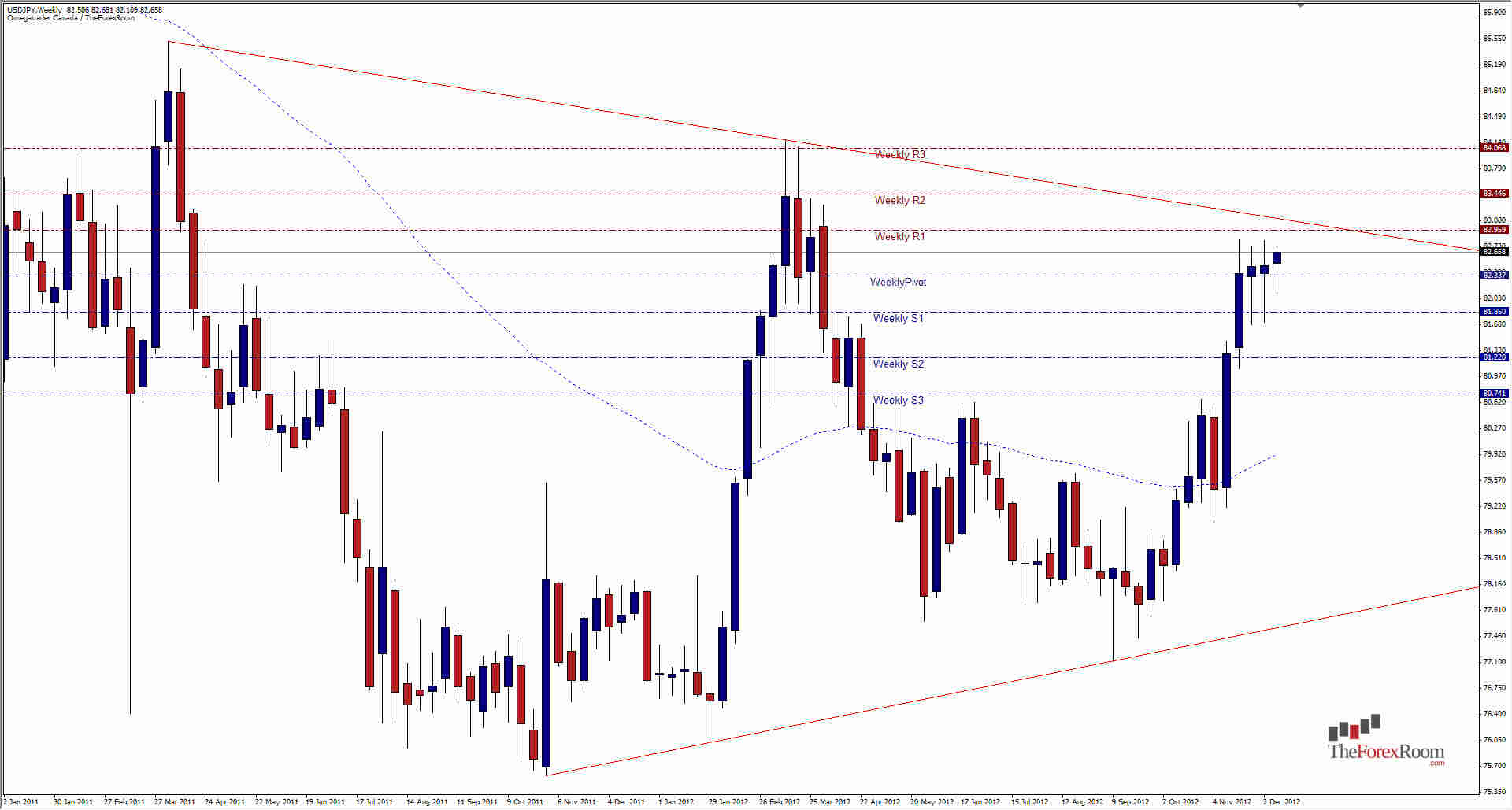

The USD/JPY seems to have 83.00 firmly in its crosshairs for the 4th week in a row. In the past 3 weeks, the pair has reached highs within 10 pips of 0.8283 each week, as well as staying above 81.60 to form a range of 140 pips +/- a few. The last 2 weeks have also formed hammer or pin bar formations on the Weekly charts, showing strong rejection of prices below 0.8160 and making this level formidable support. This is forming a pseudo Bull Flag formation on the Weekly Chart, but resistance above is strong as well. We have a descending trend-line anchoring at the March 2011 high of 85.51 and March 2012's high forming the mid point at 84.17. The current Weekly R1 lines up perfectly with the potential 3rd touch of this descending trend-line at 82.959. In this game of 'let's see who can devalue our currency the most', the Japanese are trying very hard and have basically stated they will do whatever is necessary to continue the process, providing fuel to the Bullish Momentum. Even so, the resistance is holding, and today we have the Americans throwing their latest player in the ring with the FOMC Statement later this morning. If they are successful at devaluing their currency, possibly with a 4th round of 'Quantitative Easing', the USD/JPY could skyrocket and test 83.50 and 84.00 next. If the USD strengthens however, we will be once again heading for 81.60, with 81.23 and 80.75 the support levels to watch.

USD/JPY Sights Set On 83.00

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- USD/JPY