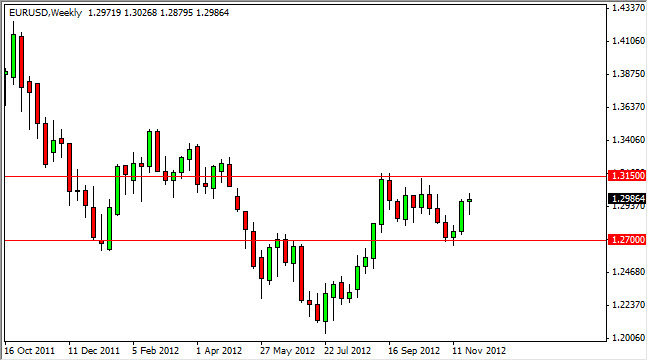

GBP/USD

This is one of my favorite pairs from a long-term perspective. This is because we had broken out of an ascending triangle over the summer, and a return trip to the 1.58 level shows the classic “breakout, pullback for support, and bounce” dynamic that we see time and time again. I believe that we will see a run back to the 1.63 level again over the next several weeks. I also see a 1.70 print sometime in 2013, and therefore am holding onto my longs in this market. This could be accelerated by the Federal Reserve if they embark on even more easing in December as some suspect they might.

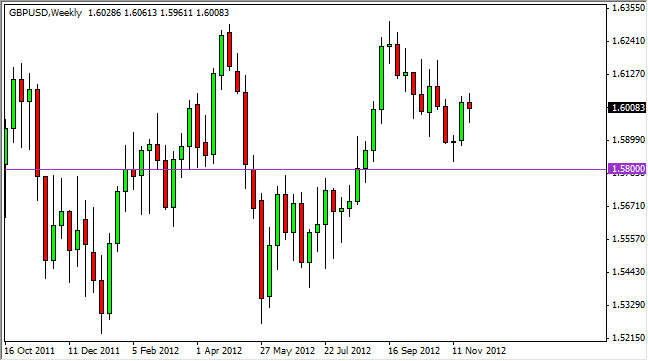

NZD/USD

The NZD/USD pair is normally one of my favorites because of the moves you can get. Having said that, it hasn’t been acting like the pair I know and love for some time now. It appears that we are essentially “stuck” between the 0.80 and 0.83 levels, and have a lot of noise between the two spots. Because of this, I see a sideways market going forward, and unless the “fiscal cliff” talks go well, this pair will go nowhere until next year as the volumes dry up later in December.

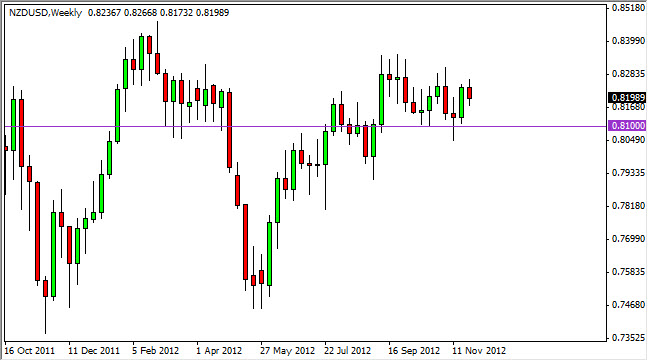

EUR/JPY

The EUR/JPY pair has been on fire lately. The move above 105 was significant, and we have even seen this pair fall back in order to retest that area for support over this last week. The resulting candle was a hammer, and this suggests to me more than ever that we are heading towards the 110 handle. I have had this as a target for a while now, and I am convinced we are going to see it in the next week or two. I am long this pair, and will continue to be. Pullbacks should be buying opportunities.

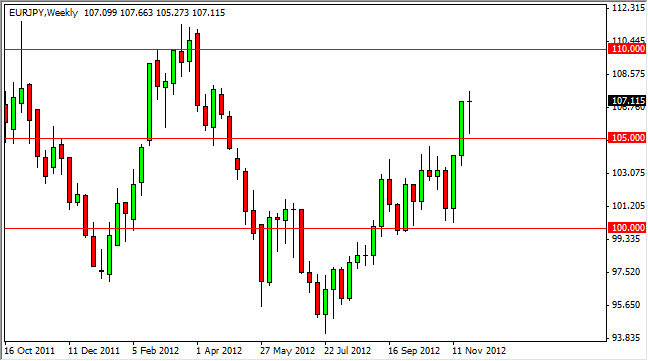

EUR/USD

The EUR/USD pair is a real pain at the moment. The 1.3150 level is currently putting a cap on the market, and the 1.27 below is just as stubborn as support. This pair will continue to be pushed and pulled by the headlines – mainly out of the US Congress currently – as they talk about the fiscal problems. However, we cannot forget about the troubles in Europe either. Because of this, the EUR/USD will continue to be schizophrenic.