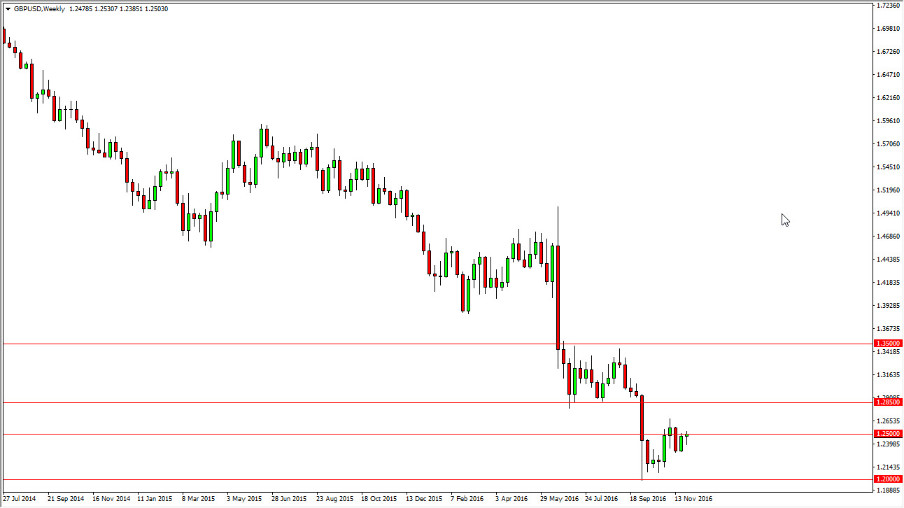

AUD/USD

The AUD/USD gained over the course of the week, but fell short of breaking out above the 1.06 level. However, it does look like it's about to do so, and a move above that 1.06 level would be very bullish indeed. If we managed to get above that area, I see a clear path to the 1.08 level in relatively short order. Also, the recent consolidation between the 1.02 and 1.06 levels suggests that we will get a move of 400 pips if we do break out. If that's the case, that lines up perfectly with a target of 1.10 in the future. As far as selling is concerned, I do not see the case to do so.

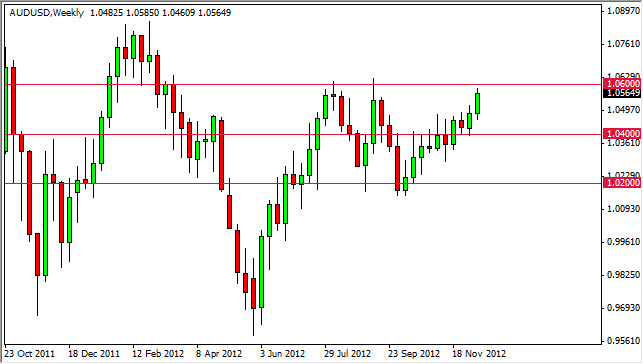

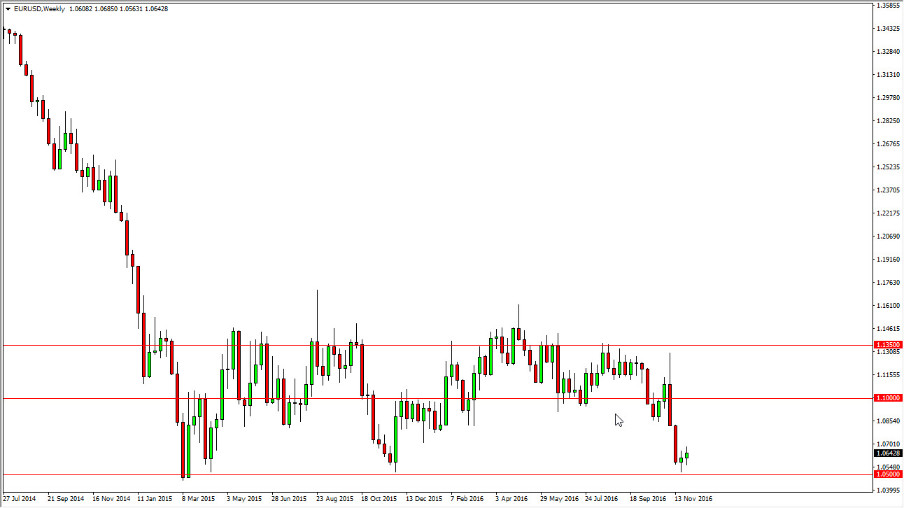

EUR/USD

The EUR/USD pair managed to break above the 1.3150 level finally, as we closed the week about 15 pips above it. With that being said, it does look like we are entering a new phase of bullishness in the Euro, especially when you look at it in its totality around the currency markets. Simply put, the Euro is being bought hand over fist against the various other currencies and of course the US dollar is no different.

I think that the move to 1.35 will be very difficult however, as there are plenty of noisy areas between here and there. I also believe that there is the possibility that the so-called "fiscal cliff" could play havoc with any rally in this pair going forward. That being said, although it is bullish looking now, I would be a bit quick to take profits over the course of the next couple of weeks.

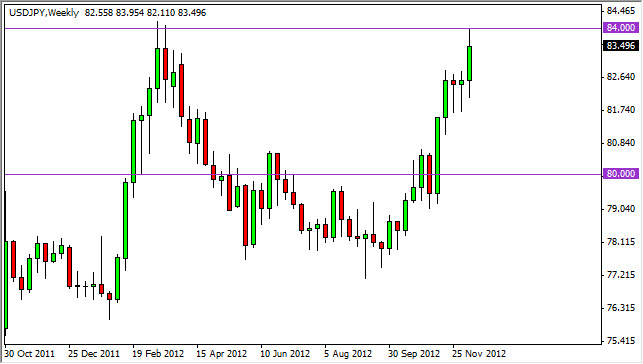

USD/JPY

The USD/JPY pair had a very strong showing this week as we tested the 84 handle for resistance. This area is going to be significant, and could be a game changer for this pair going forward. We did form a shooting star on Friday, but I believe that this is more or less traders covering their positions on a Friday afternoon.

The Japanese elections on Monday will have a great deal to say about what happens next in this currency pair. If the opposition party takes a bit of a super majority going forward, it will pressure the Bank of Japan into printing more Yen as well as expanding its asset purchases. With that being said, this will be very bearish for the Yen, and we should get a move above 84 in very short order. Otherwise, I think that the 82.50 level should offer support going forward, and as such I would be looking to buy down there if we do not get the powerful search that we could easily see.

GBP/USD

The GBP/USD pair managed to break the top of the shooting star from last week candle, and as such it does look like we are heading to the 1.63 handle. If we can get above that level, we will more than likely see 1.60 going forward as well, although this would certainly be some time down the road in 2013, and not necessarily right away. As for selling, I do not see this scenario to do so now.