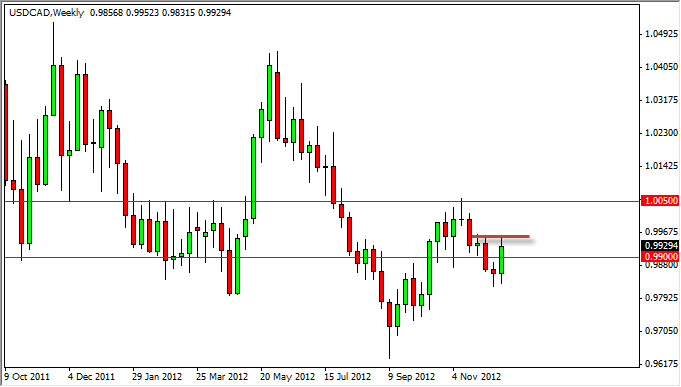

USD/CAD

The USD/CAD pair had a strong showing for the week as we closed well above the 0.99 handle. However, the market couldn’t hang onto all of the gains, and as a result I see the 0.9950 level as resistance. I think if we can get a break above that level, we should continue up to the 1.0050 level, and then higher if we can get above that area. However, I see a break of the bottom of this week’s candle as a sign that we are going lower, probably down to the 0.97 level.

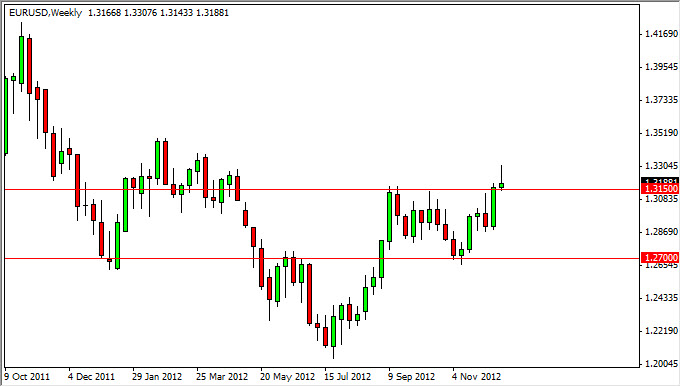

EUR/USD

The EUR/USD pair shot straight up during the past week, testing the 1.33 level. The pair failed at that point though, and as a result we fell back to form a shooting star. This candle suggests to me that we could have had a “false breakout”, and this could be a signal that we are returning to the previous consolidation area. This would be predicated upon the breaking of the 1.3150 level on a daily close. If we get that – I think the Euro will continue to fall to the 1.29 before seeing serious amounts of support.

If we go higher, and can get above the 1.33 handle – this pair will continue much higher. I think the US “fiscal cliff” talks continue to drive this market more than anything else, and as a result the headlines will continue to throw this market around.

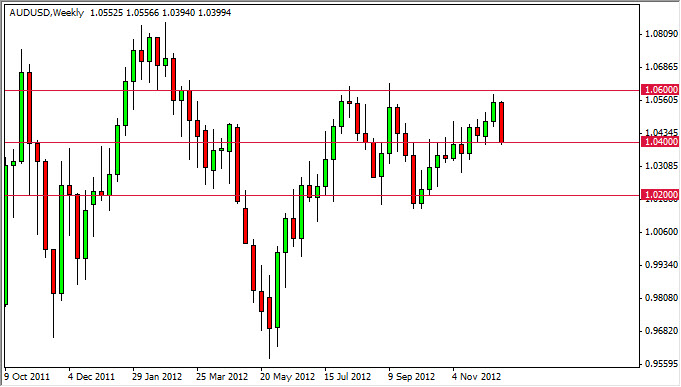

AUD/USD

The AUD/USD pair fell rapidly during the week, and parked right at the 1.04 level. This area is significant support though, and as a result it is very possible that we won’t see much more in the realm of weakness. The charts show support all the way down to the 1.03 level, and because of this, I think that we will eventually see this pair pop back up. If we get a supportive candle on the daily chart – I think we break out and above the 1.06 level sooner or later.

USD/JPY

The USD/JPY pair went back and forth, and as a result this pair formed a doji. The pair has been going strong lately, and as a result I am firmly bullish of this pair. The fact that we remain above the all-important 84 handle also confirms my suspicion that we are going higher in the long run. In fact, I believe that we will see a 90 print sometime in the first half of 2013. With this in mind, I am a buyer (again) on a break of the top of this week’s candle. I would also buy a pullback to the 82.50 level.