USD/JPY

The USD/JPY pair is probably going to be the most interesting market of 2013. I currently see that this market has one major driving factor behind the sudden bullishness, and that would be the opposition leader in Japan. Mr. Abe has already suggested that if he wins election, and it is expected that he will, that he is going to put significant pressure on the Bank of Japan to continue to print "unlimited Yen."

Because of this, the Yen has been falling against most other currencies around the world, and the Dollar will be no different. This pair has a massive resistance area at the 84 handle, but if we can manage to get above that we could see a significant buy-and-hold type of market again.

The fact that the last two weeks in a row have printed a hammer does suggest that we have serious support at the 82 handle, and as a result I fully expect to see this pair continue higher, and sometime during the year 2013 not only break above the 84 handle, but maybe run as high as 110.

USD/CAD

The USD/CAD pair fell during the week in order to break below the 0.99 handle at the end of the week. However, if not broke down below the 0.9875 level that forms the end of support for this currency pair, and as a result it isn't quite a sell signal yet. However, it certainly is close, and a move below the lows from the last week should see continued selling in this pair.

With this in mind, I am selling this pair if we break down below the lows from last week. I think that we could run as low as 0.97 the short-term and this of course would be predicated upon good news. After all, the Canadian dollar is most certainly a "risk on" currency.

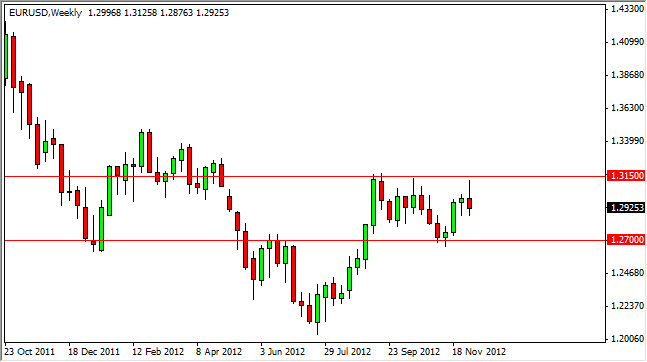

EUR/USD

The EUR/USD pair attempted to rally through the 1.3950 level, but was turned away as ECB Chairman Mario Draghi suggested that there were more board members than previously thought asking for a rate cuts. The mere suggestion of potential rate cuts in the European Union sent the Euro plummeting Middle East, and as a result you can see that we formed a nice looking shooting star.

However, you can see that the week before formed a nice hammer, and as a result it looks a little bit confused at this moment. I do see that the bottom of the shooting star and the bottom of the hammer over the last two weeks have support at the same place, so I think that a break below 1.29 will send this pair looking for 1.27 and then possibly much lower. On the upside, we need to overcome the 1.3150 level to start looking bullish again. For my money, there is a real chance of this pair goes nowhere in the meantime.

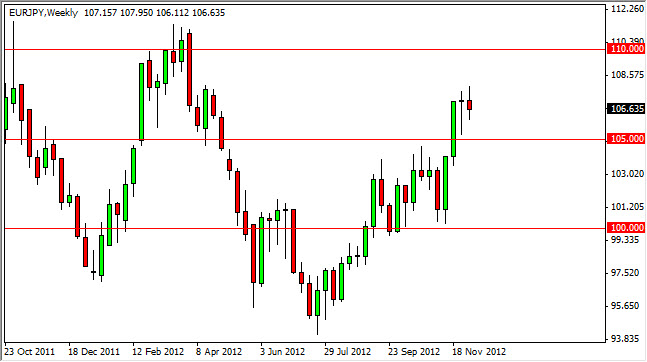

EUR/JPY

The EUR/JPY pair fell during the week, but remained within the range of the hammer that formed the previous week. The 105 level still offers massive support, and it should be noted that the Friday candle formed a hammer in this pair, and found quite a bit of support at the 106 level. Because of this, I do believe that this market is well supported, and will eventually hit the 110 handle. I also believe that this will happen much quicker than most people realize.