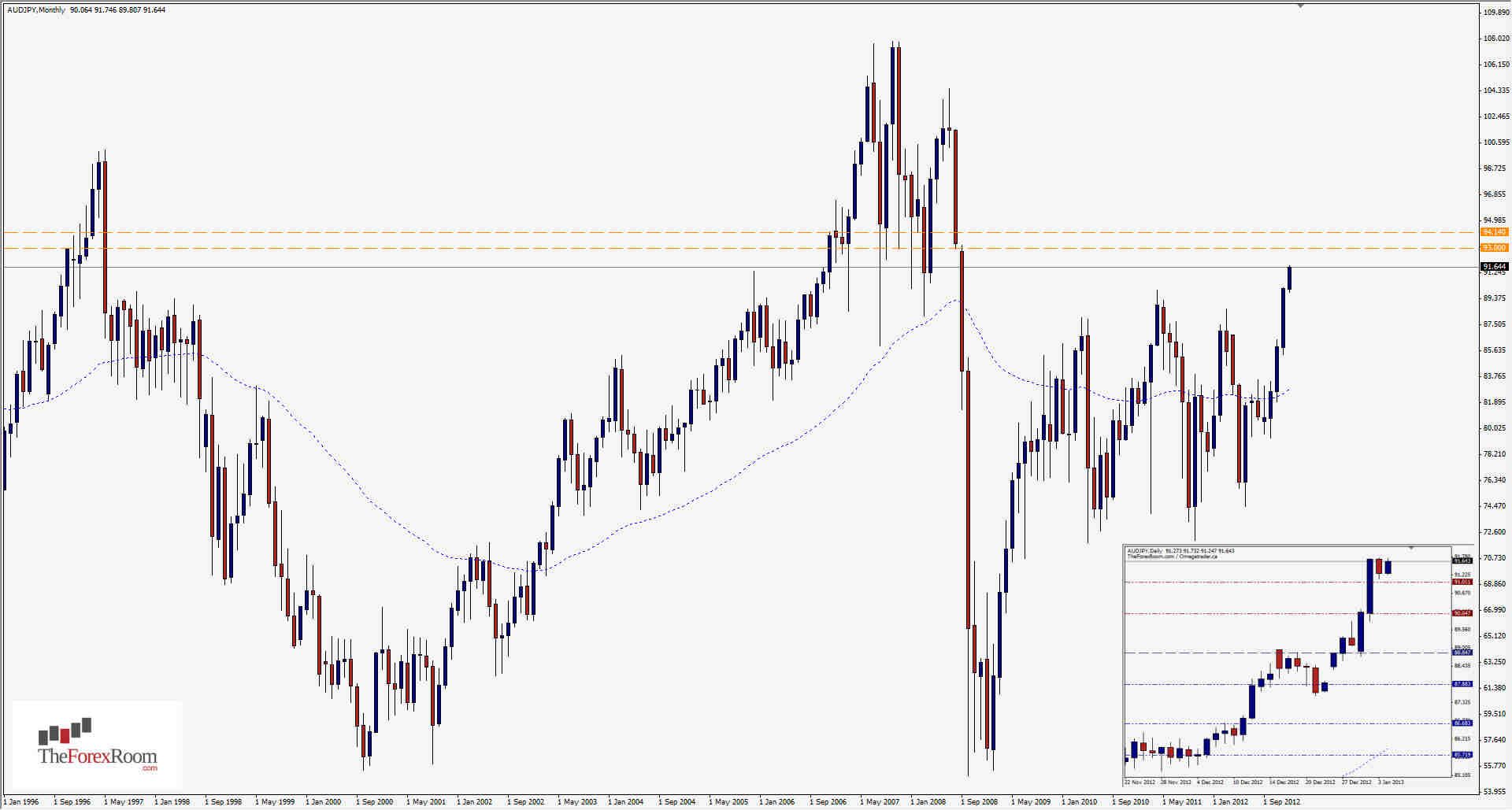

The AUD/JPY had what I call a 'breather' day. One of those days where everything just slows down and you take time to read a book, or watch a movie and just stay in your pajamas all day. That's kind of what happened with the AUD/JPY today...in spite of the Aussie Dollar weakening some against the Greenback, the Japanese Yen is also weakening and the result was an 'Inside Bar'(Inset). The entire daily range for this pair was about 65 pips, with neither a new high nor a new low being established. In a strong trend, like the one we are experiencing with the Japanese Yen pairs, this is usually a sign of continuation, but can often also signal a reversal. Since the Asian markets have all but eaten up yesterdays range already it is most likely a sign of higher prices to come. The Weekly R3 is currently at 92.21, but the ral area of interest is the 93.00 level. This level, along with 94.10 are very important to this pair as prices have historically reversed in both directions from both area's numerous times. This can be seen quite clearly on a Monthly Chart and goes back as far as 1992 when a Bullsih Monthly pin bar was printed in January that saw the bearish tone reverse and trade 800+ pips higher before falling again. There are numerous other examples, but you get the idea. I think we will hit 93.00, possibly early next week...or even tomorrow if the stars align for us. If the bears take over before we get there, look for support now at the March highs of 88.60 and the more recent 89.00 level. If yesterday's low is breached, there is a good chance 89.00 will be the target.

AUD/JPY Marches Upward- Jan. 4, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup- Labels

- AUD/JPY