The AUD/SGD pair isn't one that many people talk about, but it is an interesting pair to watch for several different reasons. The first and most compelling reason is that it is a measure of trade in Asia. After all, most Asian nations do some business with Australia buying needed minerals and other industrial materials.

Because of this, you can think of this as a measurement of the flow of money from Asian countries into Australia, which normally coincides with economic growth and expansion. For example, China may be looking to buy more and more copper, so this of course would favor the Australian dollar, as would an expansion of old demand. Keep in mind that the Chinese Yuan is a convertible, meaning that most traders have no ability to get involved in it. Because of this, the Singapore dollar is often used as a bit of a proxy for that currency.

Economic expansion?

Lately, we have seen better Chinese data coming out and the world seems to be stabilizing a bit economically. If China is in fact starting to expand at a quicker rate than recently, we should begin to see more money flow out of that region and into Australia as demand for minerals expands. Remember, Asia still has a lot of construction to be done, and as long as times are good, they will certainly do it.

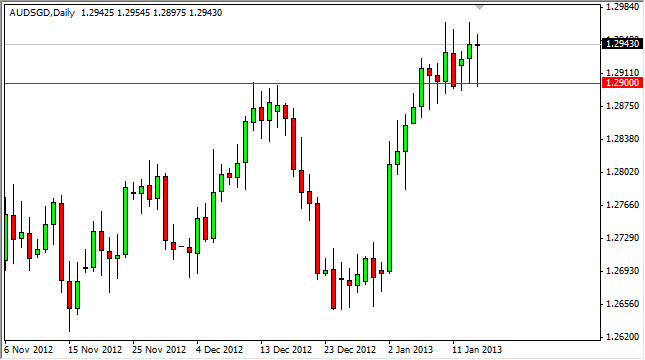

Looking at the chart, you can see that the 1.29 handle has been both resistance and support. The shape of the candle for Tuesday is a hammer, and it isn't the only one that we've seen recently. Because of this, I believe that we are going to see higher prices, but it might be a bit of a grind higher. After all, this is a pair that most traders have on the radar. Having said that, it doesn't mean that this pair should be followed. Most professional traders that I now have no qualms about trading exotic pairs and neither should you as there are normally much more clear-cut trading opportunities in these pairs. After all, the EUR/USD has been a real pain over the last two years….