The AUD/USD pair had a very strong session on Wednesday as one would expect. After all, the U.S. Congress decided to come together and sign a fiscal deal that averted so many of the tax raises and budget cuts that the markets were concerned about. It was suggested that if the automatic sequester and tax increases came into play, the United States would go into recession. This of course would be horrible for the world economy as the US is one of the few places growing right now with any significant stability.

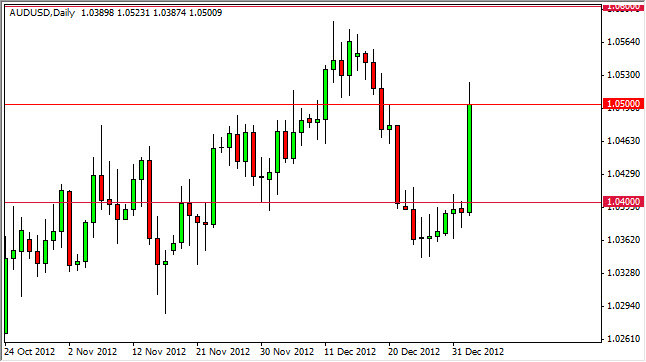

As is pair is a "risk on" market, it's not surprising to see the traders bought into it under the circumstance. However, I see that the 1.05 level has acted as resistance, which is unsurprising but needs to be paid attention to. This level could be difficult to break above, but I think the real challenge is still to be seen at the 1.06 handle. It's at that point that we would have a serious breakout over the larger time frames, and we could see a move up to the 1.10 level.

Risk on?

In the average "risk on" environment, the Australian dollar tends to do very well. Because of this, I do expect the Aussie to do fairly well over the short-term, but it may be just a bit overbought at current levels. After all, we shot straight up for the session, and sell stock markets just absolutely take off in the United States. All global stock markets did well during Wednesday, but the fact that the Dow Jones closed 308 points above where it started says everything. In other words, people got a bit too excited too quickly.

With this being said, I believe that pullbacks will offer buyers opportunities to get long of the Australian dollar. I also believe that we will eventually breakout of the 1.06 level and head towards the 1.10 level. This will take some time, and certainly won't be a straight shot up. Because of this, I think that we should see pullbacks going forward as an opportunity to participate in the longer-term move.