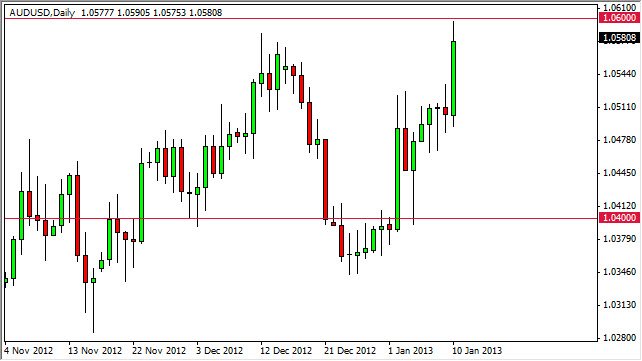

The AUD/USD pair is about to become my favorite pair I think. The 1.06 level just above is massive in its implications, and I think that this could be a serious move up. The pair is often used as proxy for China, and the Chinese let loose with very strong import/export numbers over the last 24 hours. This of course should mean that the Chinese will be buying more Australian minerals and other commodities. This of course should lead to more of a demand for the Aussie dollar, and as a result I think this pair should eventually breakout.

The pair has spent quite a bit of time in consolidation lately between the 1.02 and 1.06 levels. Because of this, typical technical analysis would suggest that you simply measure the height of the consolidation rectangle, and added to wherever you breakout. Since we are breaking out of the 1.06 level, you have 400 pips to that and you get the grand total of 1.10 for the move. I know this sounds a little bit strong, but the truth of the matter is it wasn't that long ago that the pair breaking above the 0.80 level was considered to be ludicrous.

Strong candle

The candle for the session on Thursday suggests that we are going to see quite a bit of buying pressure. Although pullback could happen, it's very likely that it will be met with some type of support shortly below.

With all that being said, this is become a "buy only" pair for me. I think it's obvious that the up trend will continue eventually, it's just a matter been able to break out of the consolidation area at this point. The more good economic news we get from around the world, the more likely we are to see this move. It's also been suggested recently that the Reserve Bank of Australia looks less and less likely to ease its monetary policy in the near-term. This of course should give a little bit more of a boost for the Aussie dollar, and send traders back into it.