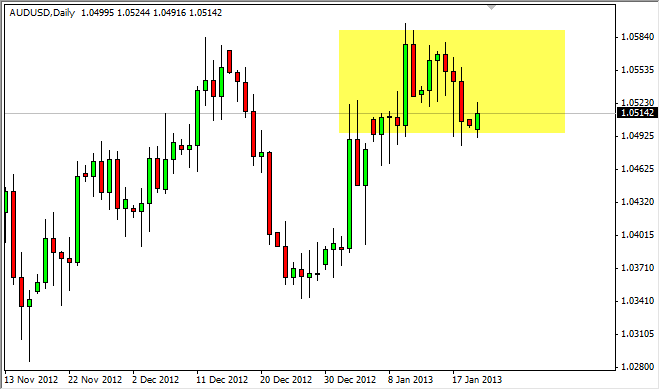

The AUD/USD pair had a slightly positive day on Monday, as the 1.05 level offered support yet again. I firmly believe that this area is the beginning of a significant base, and we are going to eventually see this pair break above the 1.06 level. It’s kind of strange that we haven't already, as the Chinese economic numbers have been better lately. There are a lot of rumblings about being able to trust the Chinese numbers, as some major players have suggested recently that the numbers are faked. My question of course is "Why does this matter now?" After all, it doesn't take a genius to realize that the Chinese have been faking these numbers for several years.

There seems to be more credence to it now though, as the South Koreans and Thais both report slower imports from China then the Chinese report as far as exports. Some of the larger analysts on Wall Street are starting to question these numbers openly, and this may have spooked the market a little bit. Also, we have had a recent unemployment number out of Australia and it looked fairly weak. Because of this, the Australian dollar has struggled as of late.

Creatures of habit

Traders are creatures of habit. This means that no matter what's going on in Australia, if there are decent economic numbers they will eventually start buying the Australian dollar again. With this in mind, I see the 1.06 level as a barrier that will eventually fall. Based upon the larger consolidation that I have seen over the last several months, I believe that the next move will be to the 1.10 level.

We have been consolidating between 1.02 and 1.06 for a while, and by simply adding the same amount of pips to the breakout point, you reach the 1.10 target. Regardless of that, this is obviously a well-supported market that I have no interest in selling. Going forward, I will be buying the Australian dollar or leaving it alone.