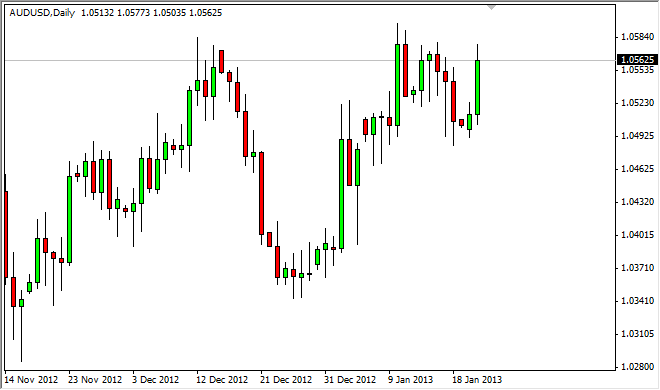

The AUD/USD pair had a strong showing on Tuesday as the market plowed higher. However, we run into quite a bit of resistance of the 1.0580 level, and as we have seen over the last couple of weeks, the Australian dollar simply isn't strong enough to chew through that area yet. However, I do believe in sooner or later this happens.

If we can get above the 1.06 level on a daily close, I think this would be one of the bullish moves of the year. After all, the Australian dollar is typically thought of as a "risk on" currency, as well as a proxy for a lot of Asian things. With that being said, this would signal that not only the Australian dollar should do well, but the entire commodity space should do well also.

1.10

Once we get above the 1.06 level, I fully believe that we will eventually hit the 1.10 area. This is based upon the consolidation that we've been stuck in over the last several months between 1.02 and 1.06, and adding the "height" of the consolidation area to the breakout point. In other words, adding 400 pips to the 1.06 level. This of course gives us a target of 1.10, and as a result this is what I expect to see.

As for selling, I find it almost impossible in this marketplace and to we get well below the 1.03 level. Even then, you still have to be concerned with the 1.02 level, and as such I just find it to be too much work to be bothered with. With that being said, I think this is very quickly becoming a "buy only" type of market, and now it's only a matter of timing the entry correctly in order to maximize profits.

With that being said, every pullback will be looked at as a potential buying opportunity by myself. Any type of support after a significant pullback I will be willing to buy going forward, as things stand right now. Also, there is a little bit of a positive swap at the end of the day that can help your bottom line as you wait out the right higher.