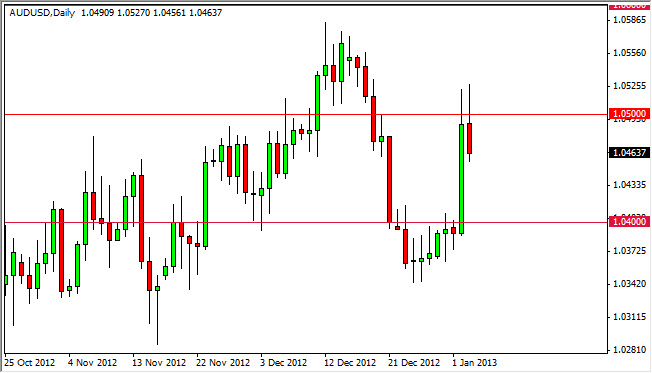

The AUD/USD pair broke above the 1.05 level during the Thursday session again, and just like it did on Wednesday, he gave back enough gains to fall below it at the close. With this being said, we formed a hammer, and it does show that the 1.05 level is significant resistance. With that being said, it will be very interesting to see how the nonfarm payroll numbers of fact the movement of the Australian dollar.

It appears that this market is still grinding away between the 1.04 and the 1.05 levels, and the recent attempts to break out have been met with significant selling pressure. I can understand how the Wednesday candle failed to close above the 1.05 level, simply because of the fact that it had come from so far below. However, Thursday should have seen the buyers step up their work and get through. The fact that they didn't leads me to believe that we will see a pullback in this currency pair over the next 24 hours or so.

Nonfarm payroll

With the nonfarm payroll number coming out later, it is going to be difficult to gauge where this pair should go. However, I think that if we rise in value and approach the 1.05 level, you will have to wants to see if the currency pair looks like it's about to fail. If so, that could be a decent sell signal for a short-term trade. Alternately, if we managed to close above the 1.05 level on a daily close, this would be the bullish signal that a lot of people would've been looking for.

Ultimately, I do not think that we will manage to break down below the 1.04 level regardless, and as a result would be more than willing to buy support down there. If you look back at the last two weeks, there are a lot of supportive looking candles in that general vicinity, and 1.03 underneath it is certainly supportive as well. It is because of this that I have a sideways Outlook on this pair with a slightly upward bias.