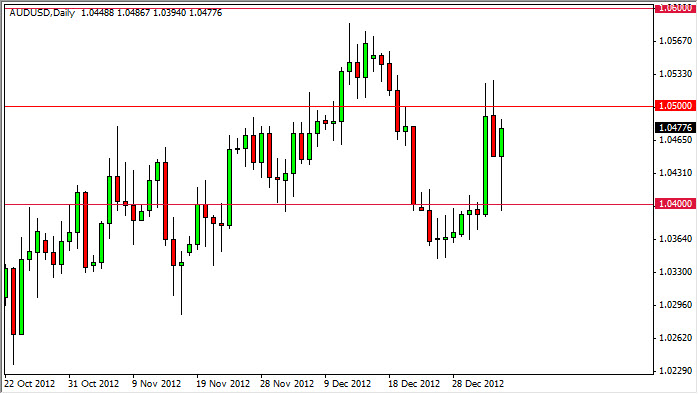

The AUD/USD pair fell to the 1.04 level on Friday, but after the jobs number came out of the United States, we get a significant bounce all the way back up to the 1.0477 area. The daily close formed a significant hammer, and I believe this shows just how resilient the Australian dollar is going to be. With all this in mind, I certainly have no interest in selling the Aussie at this moment in time.

However, I would be remiss if I didn't mention the fact that 1.05 is indeed resistive. In order for me to feel comfortable buying this pair I would have to see the Wednesday and Thursday highs taken out. If we can get above those levels, I think that we will first aim for 1.06, and then aim for as high as 1.10 over the longer-term.

Recent consolidation

The recent trading action has been between the 1.02 and 1.06 levels. When you take a breakout of that, you add the "height" of the range to the breakout spot. So in other words, if we break out above the 1.06 level, you simply add 400 pips to that level. At that point time, you get a target of 1.10 by the time the move is all said and done.

Looking at the longer-term charts, I can definitely see the 1.08 and 1.10 make sense as potential targets. I do believe that we will eventually breakout to the upside, but recognize the fact that 1.06 could stall things going forward. This of course will be predicated upon the idea of the US dollar losing value, and although the Federal Reserve shocked the markets on Thursday, we are still quite a ways away from being able to cut back on monetary policy in the United States. With that being said, both gold and the Australian dollar have been sold off far too much recently, it appears that the Aussie is going to lead the way first. It should be noted that a nice hammer was formed in the gold markets on Friday as well.