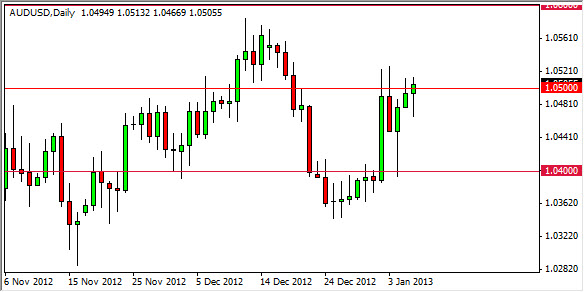

The AUD/USD pair really seemed to have perked up during the session on Monday. After all, we had seen a bit of bearishness in the early hours, but the 1.0470 level offered enough support to see the market bounced back over the 1.05 handle. At the close of the session, we are flirting with breaking above the 1.05 level for the close. This would naturally be a very bullish sign, as it has not been able to do so over the last several sessions, all of which have made a serious attempt at doing so.

The Australian dollar of course is very sensitive to the whole "risk on, risk off" attitude of the market. Because of that, I think that a breakout to the upside would be massively bullish for not only the Australian dollar, but for gold, and other commodities as well. Stock markets should rise, as should anything else risk related. With all that being said, I feel that this is a sign that we should have a good "risk on" day today.

Much higher levels

I still believe that this pair goes to much higher levels, although I can see that the 1.06 level should offer quite a bit of resistance. Alternately though, I believe that the consolidation that we've seen over the last several months should see this market not only breaking out, but eventually hitting the 1.08 and 1.10 levels going forward. I know that the idea of the AUD/USD pair hitting the 1.10 level will be a bit shocking to some of you, but it seems like just yesterday I felt the same way about the 0.80 handle.

As for selling, we do not see an argument to do so even if we managed to break the bottom of the hammer on Monday. This would technically be a "hanging man", but in reality we think that the hammer that was formed on Friday is so supportive and so large that it should continue to hold the market up on its own. We really could see a situation to start selling the Australian dollar until we clear below the 1.02 level.