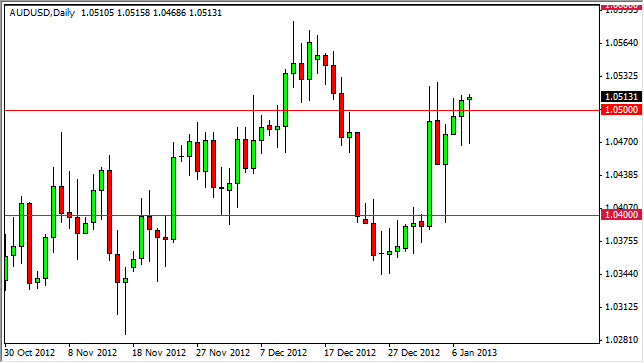

The AUD/USD pair initially fell back through the 1.05 level during the session on Tuesday to show weakness yet again. However, by the end of the session the market bounced and closed above the 1.05 level to form a perfect hammer. With that being the case, it looks like we are going to see continued bullishness in the Australian dollar.

Looking this chart, I can see that the 1.06 level is the next target for the buyers. Even if we managed to break down below the bottom of the hammer from the Tuesday session, there are far too many minor support levels below in order for me to feel comfortable shorting this pair. I believe that we are essentially in a "buy only" type of marketplace.

"Risk on"

This pair is obviously a very risk sensitive market, and as a result it's possible that we will see a bounce simply because we have had such poor performance in the stock market over the last several sessions. While it hasn't exactly been a massive selloff, we haven't exactly been positive either. We are simply due for some type of bounce.

Nonetheless, looking at this chart from a longer-term perspective you can see that the Australian dollar has been bullish for quite some time. I still suspect that this pair will break the 1.06 level eventually, and as a result I expect to see the pair eventually test the 1.08 and 1.10 levels. After all, we have been in a massive consolidation area between 1.02 and 1.06 for some time now. Technical analysis dictates that you measure the height of the consolidation pattern, and this gives you a target once you breakout. Since we have a 400 pips tall rectangle essentially, this is why believe that we will eventually hit the 1.10 handle.

This of course would need some bullishness in the marketplace, or some massive quantitative easing. I don't know what will see first, my suspicion is that we will see both eventually. This makes sense for me, and as a result I am willing to start buying on a break of the 1.0525 level.