AUD has been the out-performing commodity currency against the USD since the “fiscal cliff deal” was resolved at the turn of the New Year. This simply shows that the cross currency will always be favored by global investors, more so during periods of uncertainty due to its high yield. Analysts generally agree that the Reserve Bank of Australia is closely watching the AUD with regards to intervention.

However, the currency has at least 5 cents to cover from its current 1.05 level before the bank decides to implement its easing policy. The recent appreciation of AUDUSD has also been consistent with the increase in global demand of commodities. Being a commodity cross, Aussie has been a strong beneficiary of China’s growth and expansion over the years till date; especially with its high volume of exports to Asia’s emerging markets. In early December, the RBA made a rate cut of 25 basis points which brought the official cash rate to a 50-year, historic low of 3.00%. With this move, the bank’s two-pronged aim was to reduce borrowing costs while boosting the slow growth of Australia’s economy.

Though the rate cut was widely expected to cause a sell-off, it made AUDUSD shoot up instead. This sudden show of strength for the Aussie is a positive sign of a rising rate against the US dollar in the coming months. Since the bank’s next policy statement comes up in February 2013, another rate cut is not immediately expected until perhaps the 2nd Quarter of the year.

In the mean time, the Australian dollar can enjoy an upward ride based on the recent rate cut and the rise in commodity prices; until later in the year when another rate cycle comes around.

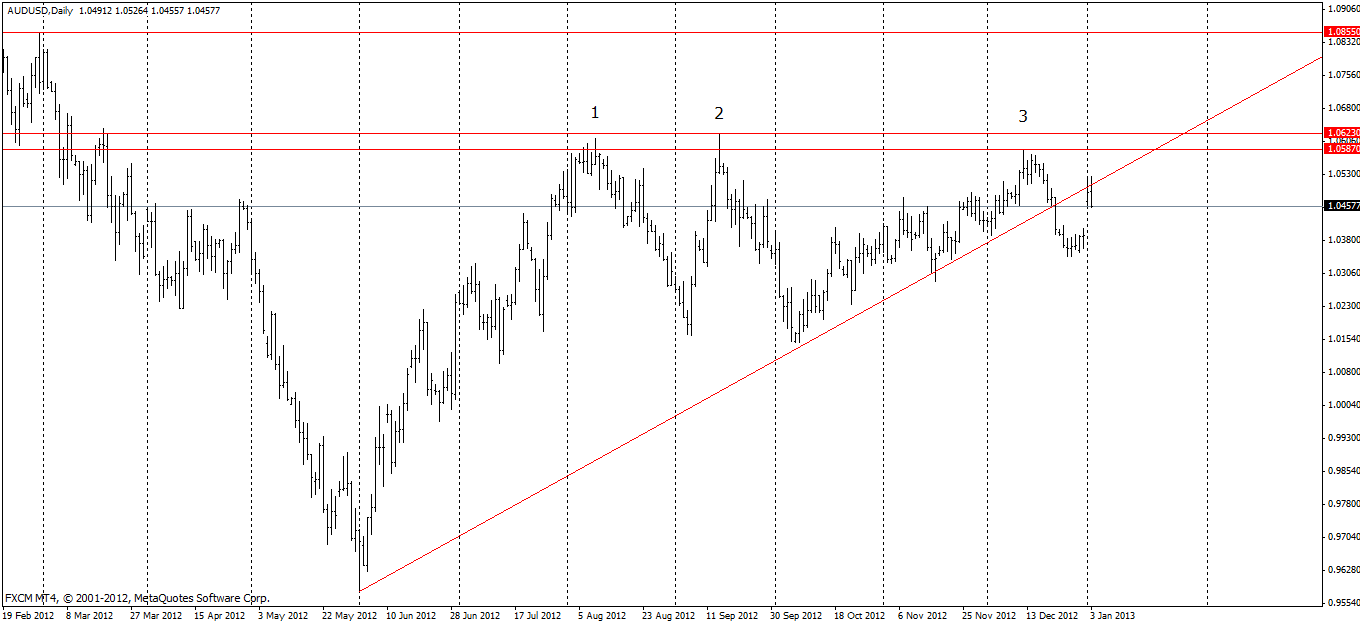

Technical studies on the daily time-frame reveal a triple top formed at the strong resistance region of 1.0587 to 1.0623 with price again heading up towards the above levels. The rising trend line is an indication of growing bullish sentiment and a soon coming upward breakout.

A failed downward breakout below the trend line further reinforces the bullish buildup. Near term, Aussie is expected to return to the 1.06 level before a continuous journey towards 1.085. The latter represents a 3-month outlook for AUDUSD. A bolder 12-month forecast stands at 1.10 which is also an interesting level for the RBA. This means traders can be on the look out for weakness towards the 1.02 to 1.03 area to be well positioned for a huge buying opportunity.