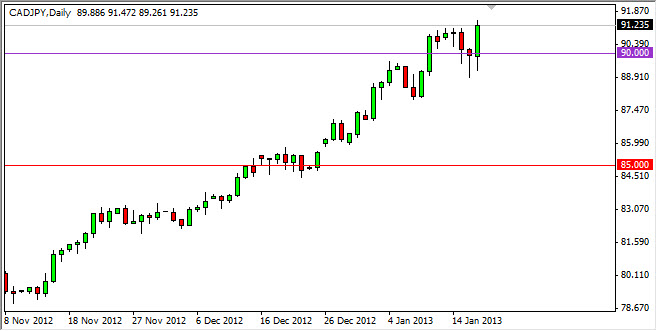

The CAD/JPY pair had a very strong showing during the Thursday session and managed to make a fresh new high. This makes sense though, because the light sweet crude market itself broke out to the upside. This pair is the ultimate petroleum sensitive market as the Japanese import 100% of their oil, while Canada of course is an exporter.

As the price of oil rises, this pair predictably grinds higher with that most of the time. The fact that the Bank of Japan is currently working against the value of the Yen certainly doesn't hurt the bullish case in this market either. Now that we have proven the 90 handle to be supportive, it does look like we can continue higher as the breakout continues.

Looking forward, I believe that the 95 handle will be targeted eventually, and it should be said that if you do not want to be involved in this particular pair, it is a little bit of a harbinger of what could happen in the USD/JPY pair as well. Currently, that pair is sitting just below the 90 handle, and looking to breakout.

Oil markets should keep propelling this pair higher

The light sweet crude market looks like it's ready to move another five dollars or so higher. If that's the case, this pair should continue to have enough juice in it to push prices higher. I believe that we will see this, and that anytime this pair pulls back it will be a buying opportunity going forward. Not only do you have the advantage of selling the Yen, you also have the advantage of buying a commodity currency which on the whole means that should do well as central banks around the world continue to devalue their currencies.

I am still bullish of this pair, that I actually believe the "floor" in the market is down near the 85 handle, and as such we have plenty of room below in order to catch any prices the fall. I will not sell this pair, and I do believe that watching the USD/CAD pair also can give you a heads up as a breaking below the 0.98 handle would signal massive Canadian dollar strength.