The EUR/AUD pair is one that I don’t normally follow much. However, the session on Thursday was so pro-Euro; I started to look around the Forex markets at all of the EUR/XX pairs, and came across this one.

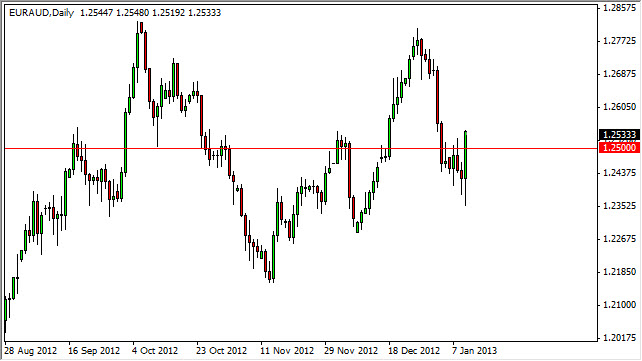

The pair typically is a choppy one, but will sometimes have a very impulsive move to suggest where it is going next. The Thursday session candle engulfed the previous five candles, which is something you always have to pay attention to. A break of the 1.25 level of course meant something as it is a large round handle, and the fact that we had originally falling during the session on Thursday to only turn around and bounce over all of the resistance is indeed a very strong signal.

Now that we've cleared this hurdle, it looks like this pair to grind higher. You can also see that the lows have been getting higher overtime, so this does jive well with the trend since early November. Again, not a pair that I trade much but I have to admit that this looks like a pretty decent set up. This pair also suggests to me that although the Australian dollar looks fairly bullish, it's actually the Euro is going to do more in terms of movement. Remember, this is simply an amalgamation of the EUR/USD and AUD/USD pairs.

1.25

As for myself, I believe as long as we can stay above the 1.25 level this will be a "one-way trade." The candle on Thursday is a fairly rare want to see, and as a result this truly has piqued my interest. Because of this, I will be buying this pair on a break above the highs from the Thursday session, and aiming for the 1.27 level at the very least. This pair does tend to trend for weeks on end as you can see, so making that type gain really wouldn't be that big of a surprise. In order to sell this pair, I would have to see the bottom of the massive Thursday candle get broken. This is something that I do not expect to see anytime soon.