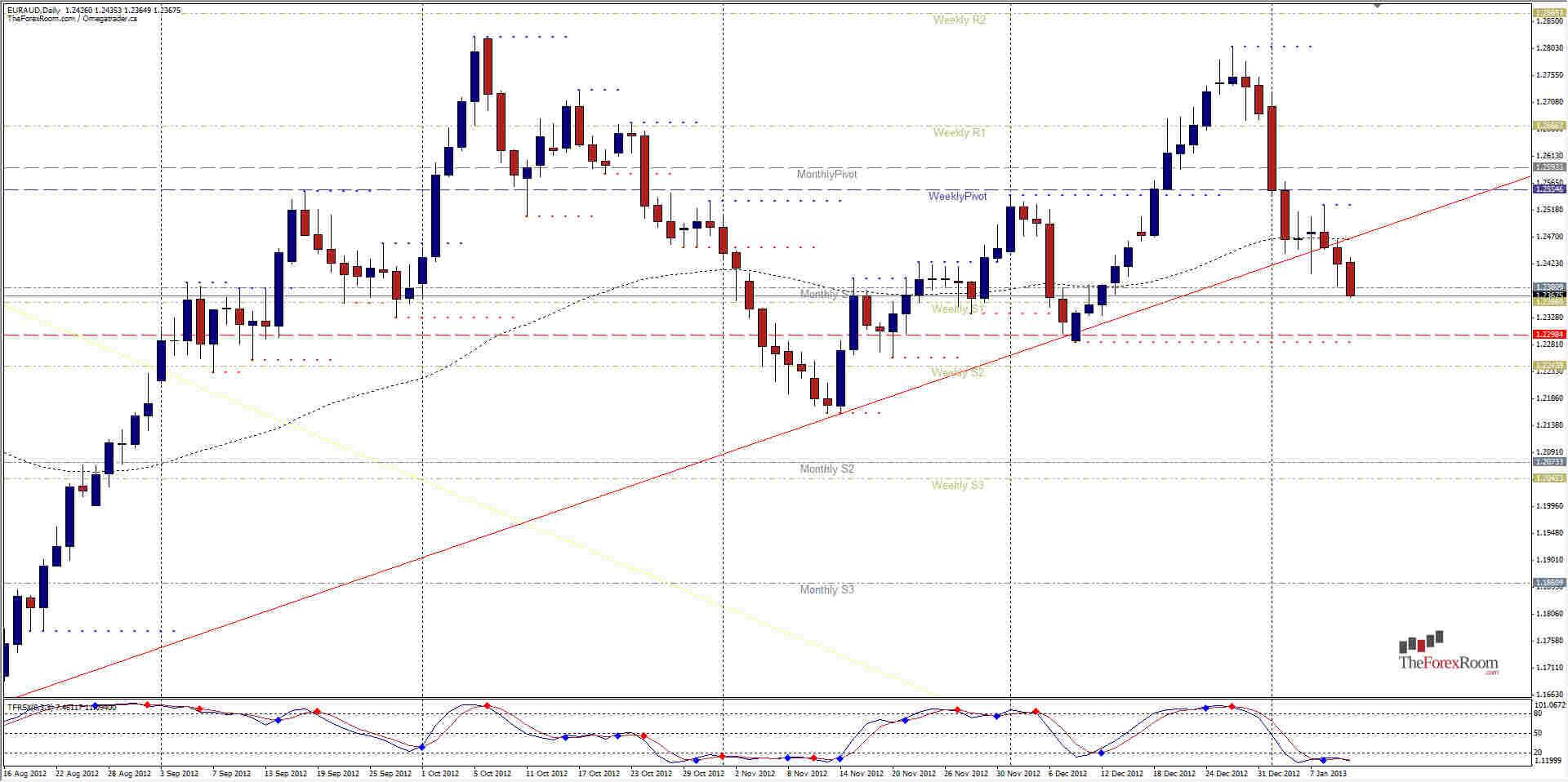

The EUR/AUD has fallen some 440 pips since December 28 when it reached a high of 1.2806, not as high as the September 2012 high of 1.2823, but very close and the double top proved to be an excellent selling opportunity for anyone wise enough to sell the pair at that level. Now we are approaching 1.2350, a solid support level for the pair with some strength and it's not yet clear if the zone will hold the pair up. The Australian Dollar received a significant boost after China reported much stronger exports than expected and placing higher demands on Australia's raw goods in turn. Meanwhile, the EURO continues to show weakness after failing to hold above 1.3050 as the Asian markets wind down. Further downside for the EUR/AUD will bring the December low into play at 1.2286 followed by April 2012's low at 1.2133. If 1.2133 is breached there is a technical vacuum from there down to 1.1605, basically the all time low. If the pair finds support at 1.2350 as I'm expecting it to temporarily at least, we could see some bullish action back towards 1.2460 before falling again as this pair seems hell bent on going lower, making upside trading risky until we see that one of these key support levels can hold and give us some indication that the bears are finally exhausted.

EUR/AUD In Freefall, Jan. 10, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/AUD