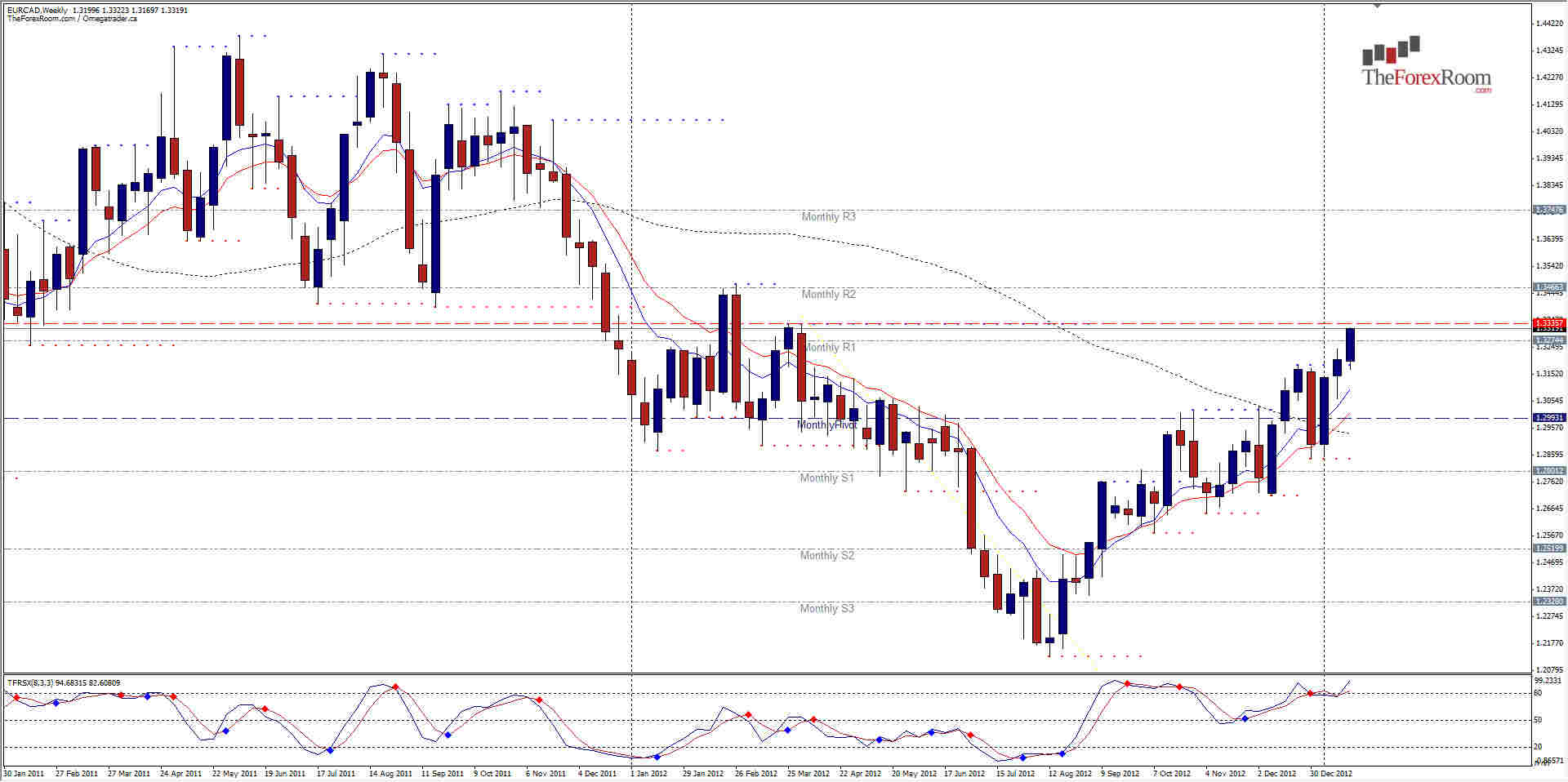

Yesterday the EUR/CAD rocketed upwards over 100 pips after the Bank of Canada left the interest rate unchanged. The EUR/CAD has been steadily marching higher since establishing an all time low in August at 1.2129. Now, the pair is at a key resistance level of 1.3335 (lows from 2007, high's from March 2012) and looking like its full of bullish steam. That said, there is also a high percentage that this could be the reversal point, and should be monitored closely. A close above 1.3335 on a daily time frame could see the pair reach for February 2012's high at 1.3480 and then November 2011 lows at 1.4550 or so. In between we will have resistance at 1.3460 and 1.3750. If we get a reversal here, and according to levels on the Stochastic we are drastically overbought, a pullback to 1.3000 is imminent with plenty of support at this area. Below 1.2800, the Monthly S1, 1.2500 will be the likely target.

EUR/CAD Reaches Higher- Jan. 24, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/CAD