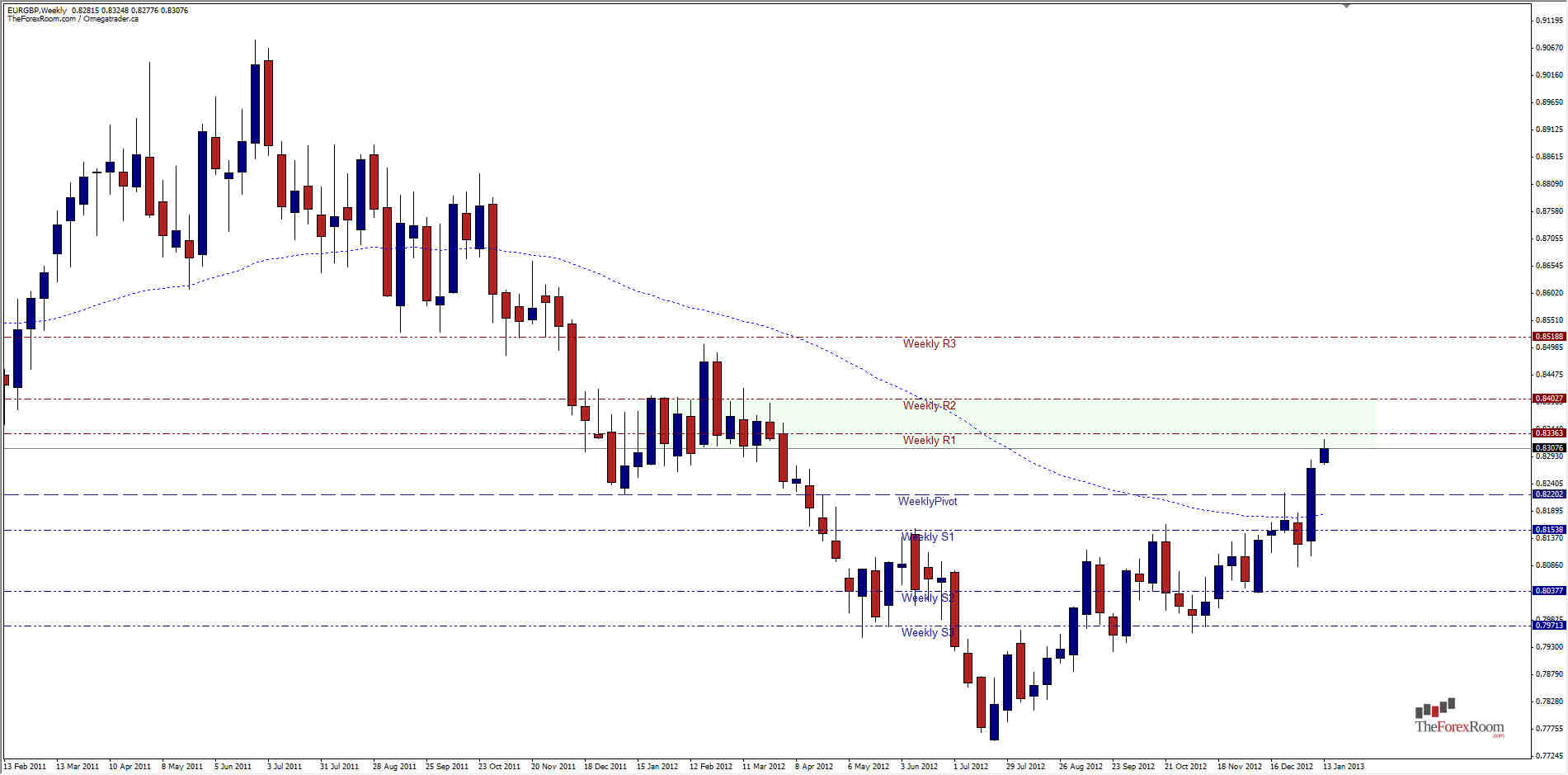

The EUR/GBP has gapped up this week, and after yesterday's trading has also hit the bottom of a resistance zone that held the pair captive from January through March of 2012. At that time, the pair traded in a tight range, unable to break above 0.8400 or below 0.8300. Yesterday's high was 0.8325 and we note that this was the low of the week of March 25, 2012. The bulls will have to work extra hard now in order to overpower the bears at this point. I would expect a pull back of some extent, possibly to 0.8100, the 38.2 Fibo pertaining to price action from July 2012 to now. We also have the 62 EMA at this level which will act like a price magnet if we can't close above 0.8400 relatively quickly. A move above 0.8400 will place the pair in a position to revisit the lows from December and the Weekly R3 at 0.8518 but there will be additional resistance at 0.8459. To the downside we have the Daily S1 at 0.8289 and Daily S2 at 0.8260 offering support before the Weekly pivot is realized at 0.8220 (the highs from December 2012.

EUR/GBP Hits Resistance Jan. 15, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/GBP