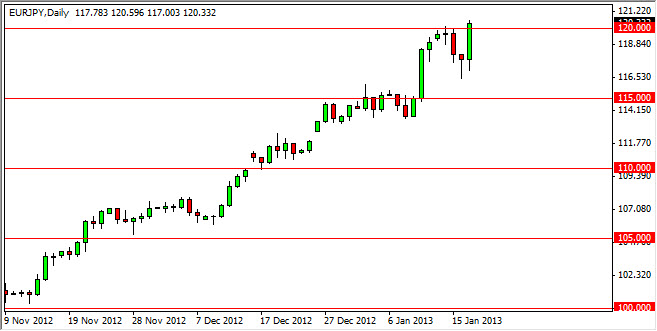

The EUR/JPY pair has been a one-way ride for some time now. The move that we saw on Thursday simply put an exclamation point on that reality. We had a nice hammer formed on Wednesday, and this of course was always bullish and signal that we would perhaps try to breakout and above the 120 handle. We have done that, and as a result it looks like we're going to go even higher.

I find this move absolutely astounding. Yes, I understand that the Bank of Japan is going to work against the value the Yen, but in reality this move has been absolutely remarkable. When you think that just two months ago we were at the 100 level, this is truly aggressive. However, no matter how overextended this pair may look at the moment, you simply have to buy the pullbacks until proven wrong.

100 and above

The spacing I believe as long as we are above the 100 handle, selling this pair is absolutely forbidden. With that in mind, I will buy every supportive candle as we have just been proven to be correct in the last 24 hours. After all, most people would think that this market was overextended on Wednesday! The fact that we managed to slice through 120 without too much difficulty shows just how much bullish behavior we are seeing in the market right now.

As long as the Bank of Japan is out there and willing to work against its own currency, I believe that the Euro will continue to climb against the Yen. However, be aware the fact that moves like this that of this violently aggressive tends to have very sharp pullbacks sooner or later. Recognize this sharp pullback as a buying opportunity and simply stay put until you see some type of supportive candle on the daily chart. If you do that, you could find yourself buying this pair at a lower price and hanging onto this trade for several months if not years. In the meantime though, keep taking bites out of this pair on the upside as we should continue to see bullishness.